Value over volume

DEEP DIVE: Gas-fired power demand is crashing, but its system value is soaring

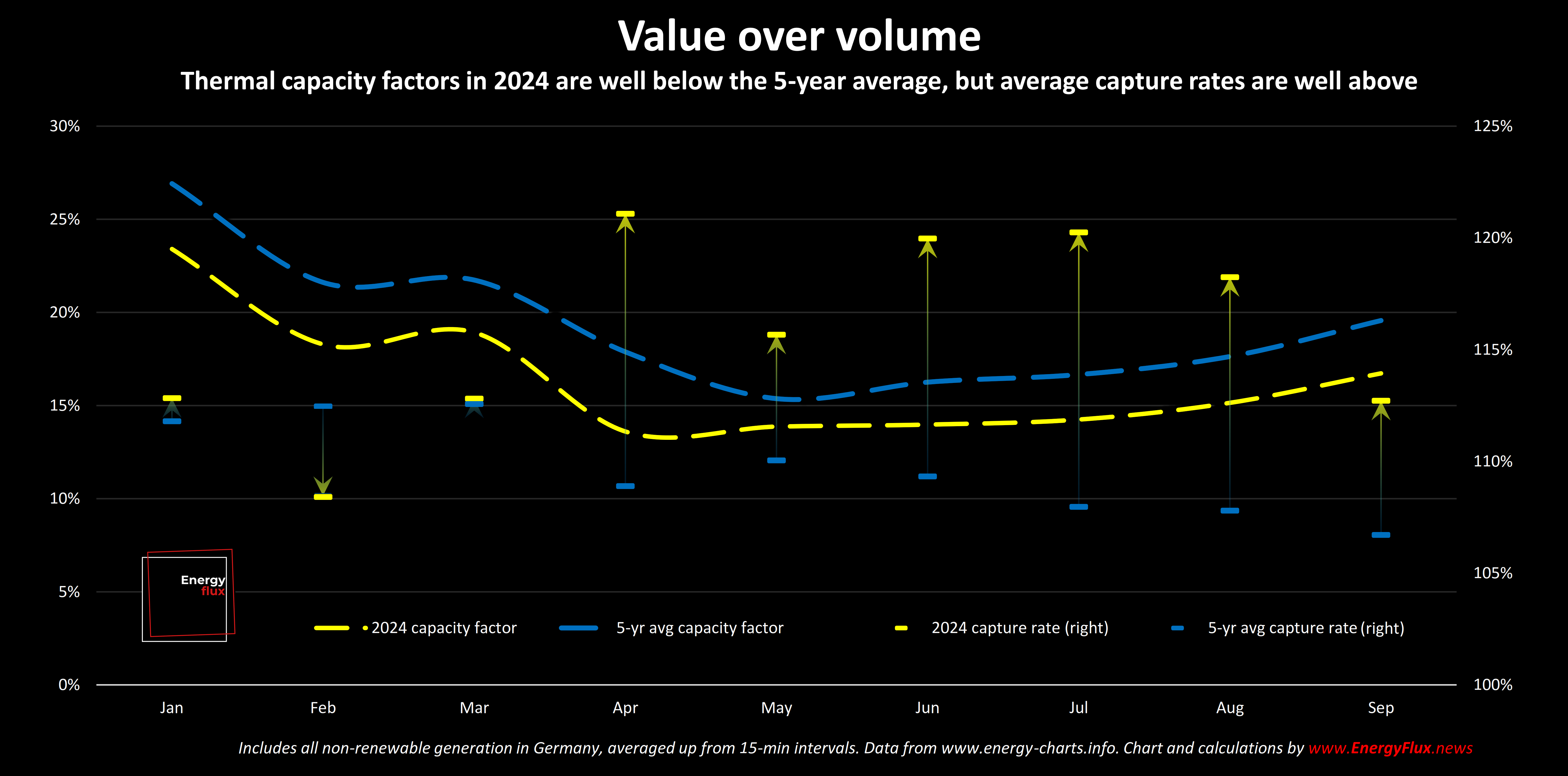

The role of natural gas in Europe’s power sector is moving from volume to value. As gas is increasingly marginalised by renewables, each kilowatt-hour of flexible gas generation is capturing higher market revenue.

As revealed by Energy Flux in August, pan-European gas-fired power is currently lower than at any time since 2005. But that only tells half the story.

Gas power plants are cutting back overall running hours as zero marginal cost wind and solar flood electricity grids. Thermal plants are increasingly called upon only when prices are at their highest – when weather-dependent sources are unavailable.

The upshot is that coal and gas are retrenching into the highest-value settlement periods. Analysis of grid data from Germany confirms this trend.

Average thermal (coal and gas) capacity factors are ~16% lower in 2024 compared to the five-year average, according to Energy Flux analysis of data from research institute Fraunhofer ISE.

At the same time, the average ‘capture price’ of coal and gas plants is 42% higher in 2024 compared to the 2019-21 pre-crisis period.

Capture price refers to the weighted average price a generator receives for the electricity it sells in the market, accounting for day-ahead price fluctuations and the time of generation.

Renewable energy capture prices are trending downwards, because wind and solar generate only when the resource is available. More wind and solar means greater temporal correlation of generation, leading to lower capture prices – a phenomenon known as ‘price cannibalisation’.

But the opposite is happening for coal and gas. Since these plants are dispatchable, they can optimise revenue by generating during periods when prices are highest – typically when renewables are not available. This allows them to consistently capture prices that are above the overall day-ahead average.

Capturing value

A useful yardstick here is the ‘capture rate’. This is the ratio of the generator’s capture price to the average market price over the same period.

Capture rate reflects how effectively one power station, or a group of generators, can capitalise on price volatility relative to others, or how this changes over time.

The capture rate of coal and gas plants in Germany is on average 6% higher in 2024 than it was over the preceding five years. This is a significant increase.

However, at the other end of the spectrum, the renewables deluge is increasingly pushing coal and gas generation into negative pricing periods. There are several reasons why this might be happening, which this piece digs into.

This data-rich Deep-Dive takes a granular look at the impact of Germany’s renewables rush on the value proposition of gas-fired power, and the implications for policymakers considering the role of thermal generation in Europe’s rapidly changing power mix.

While the story is more nuanced than the dramatic trend of crashing gas generation might initially suggest, the loss of the ‘volume’ role – catering to base load – cannot easily be replaced.

As the data reveals, the shift from volume to value is by no means a like-for-like substitution of lost revenue. At the same time, thermal plants’ ability to retain their share of the highest-value market periods is under threat on various fronts.

- This post is a comprehensive analysis of the dynamics of thermal generation economics in the context of Germany’s energy transition. For the best reading experience, I encourage viewing it online in your browser.

Article stats: 2,500 words, 12-min reading time, 14 original charts and graphs

Member discussion: Value over volume

Read what members are saying. Subscribe to join the conversation.