US LNG’s affordability crisis

DEEP DIVE: America is losing its competitive edge in the Asian LNG market

The Trump administration’s energy policy is full of contradictions.

Not long ago, Energy Flux explored how the mission to maximise LNG exports runs counter to Donald Trump’s campaign promise to put ‘America first’ and keep domestic energy prices low.

Now, there’s another paradox rearing its head: cheap oil will make US LNG less competitive in key importing markets across Asia.

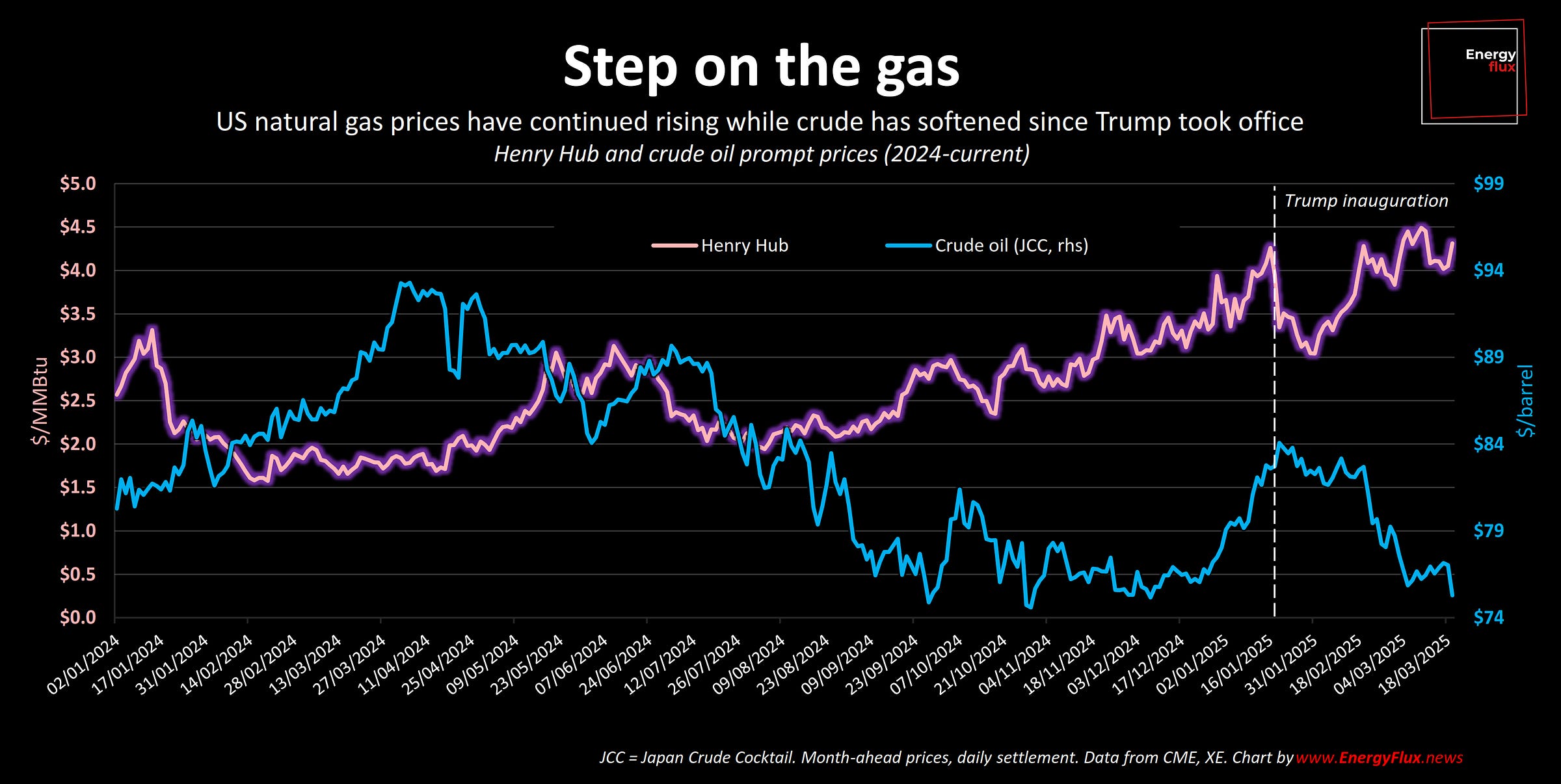

Oil prices have fallen by more than 10% since Trump took office, and the White House is (erroneously) claiming credit for this. At the same time, prices on Henry Hub – the US natural gas benchmark – have risen 13%.

Few economic indicators are as hardwired to the incumbent administration’s approval rating as the price of gasoline at the pump. Remember these anti-Biden gas pump meme stickers?

Senior advisor Peter Navarro recently predicted that oil prices could fall as low as $50 per barrel.

This is a wayward forecast, but not beyond the realm of possibility.

If it came true, $50 oil would be a welcome reprieve for consumers braced for a spike in inflation that Trump’s tariff trade war is widely expected to trigger.

However, it would also be kryptonite for his administration’s hopes of selling large volumes of US LNG into Asia.

This Deep Dive examines why cheap oil is eroding the competitiveness of American liquefied natural gas, and the likely impact of $50 crude. Spoiler alert: it ain’t pretty.

Subscribe now for full access, and support independent energy market analysis.

Article stats: 1,900 words, 9-min reading time, 6 charts & graphs