Turning point?

Hedge funds are tempering bullish bets on European gas prices. Is this a momentary blip, or a change of direction? | EU LNG Chart Deck: 2 September 2024

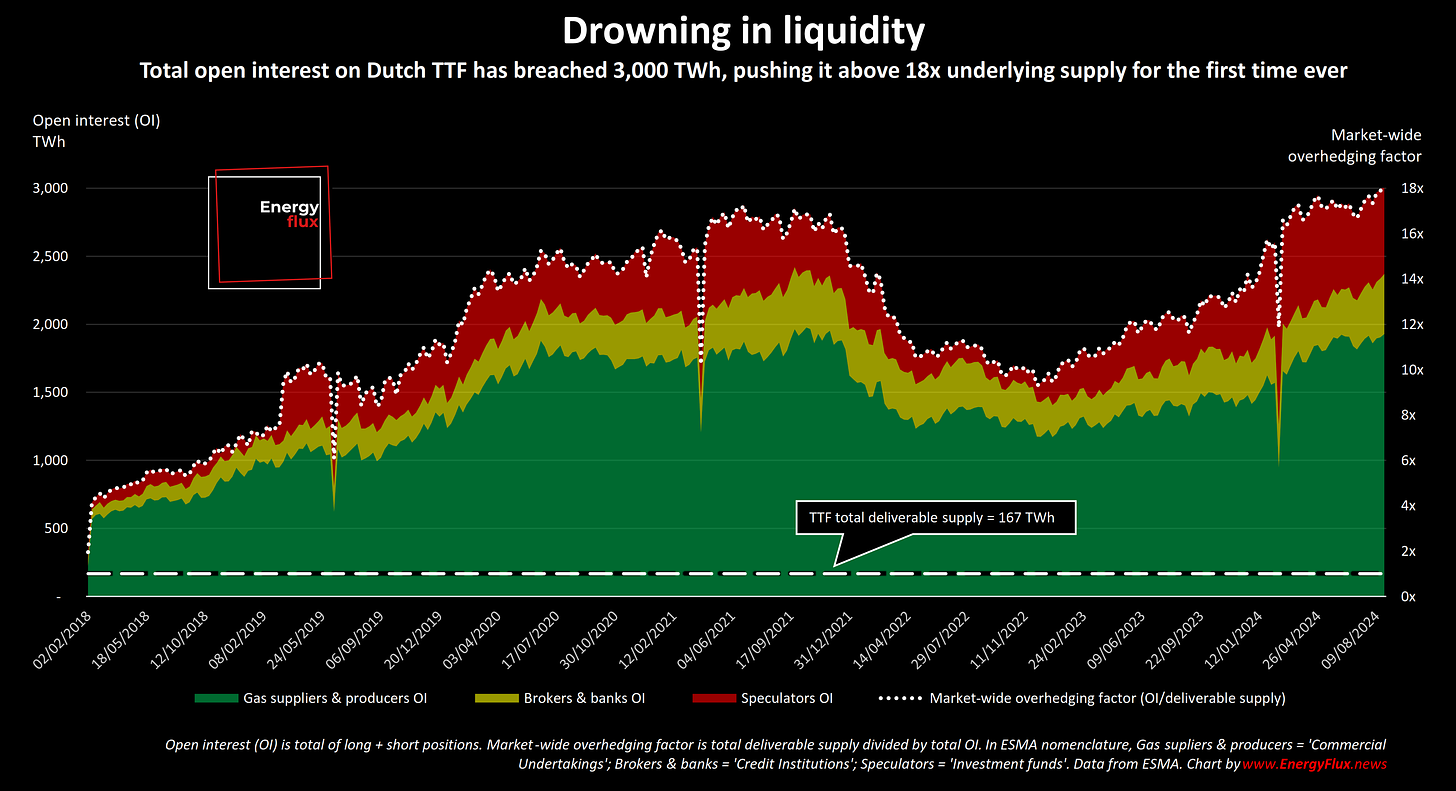

Depending on your perspective, the positioning of investment funds is now either the single biggest factor influencing European natural gas prices, or the best available indicator of where prices are heading.

In either case, when hedge funds shift their weighting on the Dutch Title Transfer Facility (TTF), it is worth scrutinising.

A speculative frenzy fuelled a 75% rally in TTF prices since February, and funds keep piling in.

Total open interest on TTF breached 3,000 TWh for the first time in late August, which is a mind-boggling amount of gas: equivalent to 307 billion cubic metres, which is more than the entire annual gas demand of the EU in 2023.

Open interest is now 18 times greater than underlying supply of gas in the Dutch market, a feat attributable in large part to the influx of speculative capital over the last 18 months.

However, the latest data from the European Securities and Markets Authority suggests that these bullish hedge funds are (at the very least) pausing for breath by reducing their net length in TTF futures.

Simultaneously, the physical players — gas suppliers and producers — reduced their net short position. For a variety of reasons (which I’ll dig into below), this tends to indicate the current cycle could be at or near its peak.

This week’s EU LNG Chart Deck explores these developments to try to understand whether this is a temporary blip or the start of a new market phase.

Article stats: 1,600 words, 8-min reading time, 11 original charts and graphs