The rain in Spain (part 2)

Iberian gas price cap comes into force. What now for Spanish hydro – and consumers?

“Under no circumstances should it cost €320 (or even €100) to generate one megawatt-hour of electricity from a fully amortised utility-scale power station that repaid its construction costs many times over ago and has no fuel costs.” – Energy Flux, May 2022

The European Commission has approved a contentious Spanish and Portuguese measure to cap and subsidise fossil fuel-fired power generation. We are about to find out whether this creative intervention in pay-as-clear (PAC) power markets will bring down costs for hard-pressed consumers. For that to happen, it will need to influence the curious bidding strategies of Spanish hydroelectric power stations – which seem to be gaming the PAC price-setting system. If the cap succeeds, the rest of Europe will be clamouring to replicate the Iberian experiment. If it fails, PAC’s susceptibility to manipulation will be laid bare for all to see.

This article explains how the cap works, the effect it could/should have on day-ahead auctions in the Iberian power pool, and whether/by how much it will lower retail prices. Spoiler alert: on the latter, nobody really knows — but we will soon find out!

First of all, let’s recap. As Energy Flux reported in May, hydropower plants are setting day-ahead prices in the Spanish power pool surprisingly frequently – much more often than combined cycle gas turbine (CCGT) power stations. This is curious because CCGTs must cover their fuel costs, while hydro has zero marginal running costs so in theory could bid at zero and take the clearing price set by (expensive) gas.

When you consider that most (all?) Spanish hydro plants are fully amortised, the idea of ‘cheap’ hydro pushing power prices higher during a gas crisis seems perverse. The assertion that hydro plants are effectively gaming the system prompted one reader (a power trader) to offer this perspective:

“If the plant is reservoir hydro, then water taken out now has to be balanced out against water taken out in the future. As such, the value of water today is linked the forward curve (similar to gas storage). This can become more or less pronounced dependent on whether water levels are above or below normal levels.

“If they have too much water or they are confident in the weather forecast, they price it lower as there is no point having a full reservoir and then needing to dump the water. If they are in [drought] conditions, they have no choice but to price the water ‘high’.”

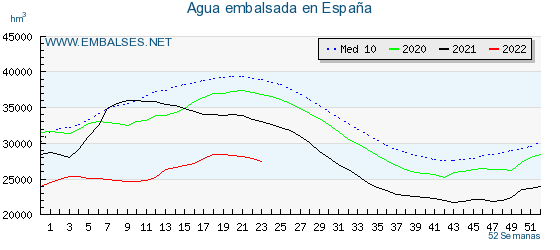

Spain is enduring severe drought conditions, so bad in fact that ghost towns are resurfacing decades after being flooded to make way for dammed hydro plants (these photos are quite incredible). Anyway, Spanish hydro reservoir levels are running well below the ten-year trailing average:

So, are hydro operators ‘gaming the system’ or bidding strategically to preserve water resources? And how might the gas price cap shake things up? Let’s break it down.

Article stats: 2,050 words / 4 charts & graphs / 10-minute reading time

Member discussion: The rain in Spain (part 2)

Read what members are saying. Subscribe to join the conversation.