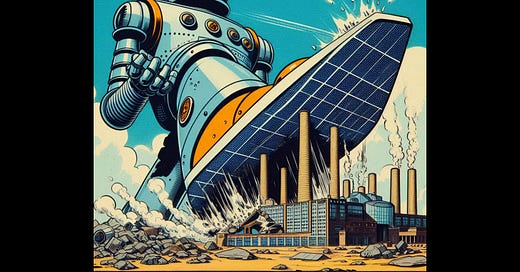

Renewables are crushing gas-fired power

But wind and solar are no panacea for Europe’s fragile electricity system

Europe’s electricity system is transitioning at breakneck speed. Renewables are displacing thermal generation so fast that gas-fired power has slumped to a two-decade low.

Continental Europe produced less electricity from natural gas over the first seven months of this year than at any time since 2005, according to research by Energy Flux. A few countries bucked the trend, but at the regional level there is no sign of this changing any time soon.

The continent’s full-throttled embrace of wind and solar — combined with the return of French nuclear, and Alpine hydro, milder winters and a weak economic recovery — has dislodged gas from the heart of many EU power markets.

The transformation is both astonishing and alarming. Europe’s great gas power slump has wiped out the equivalent of the combined annual primary gas demand of Denmark, Ireland, Norway and Portugal since 2017. That’s roughly 240 cargoes of liquefied natural gas (LNG) every year, no longer needed.

Since LNG is the marginal molecule, this implies Europe could over time pivot away from not only Russian imports, but also LNG — which is more expensive, volatile, and carbon-intensive than pipeline gas.

But dig a little deeper, and the speed of transition is also embrittling European power markets. Rising intra-day volatility, negative pricing, infrastructure bottlenecks, soaring balancing costs and incoherent policy responses are all straining pan-European market integration.

This (very long) post dives into the latest data from ENTSO-E, the European Network of Transmission System Operators for Electricity, to define the contours of the gas generation slump and the factors driving it.

It then takes a whistlestop tour of European power markets to put this historic slump into national context, with charts visualising 2024 gas generation against the five-year historical average in each country. Here’s a quick overview:

Introduction: Anatomy of a fall

Policy: Managed decline or messy antagonism?

Italy: Europe’s gas power giant turns to nuclear imports

France: Nuclear renaissance squashes gas power

Spain & Portugal: Value over volume in Iberia

Germany: Renewables surge tempers coal-to-gas switching

Netherlands: Renewables crowd out gas, as far-right coalition beds in

Romania: Too much gas, not enough capacity

Austria: Post-gas era beckons as Ukraine transits end

Slovakia: Booming nuclear & hydro keep gas in check

Poland: Gas flexes as coal-to-solar transition bites

Greece: Gas bridges gap between old and new energies

Be warned: this post is much longer than usual, so be sure to load up the online web version in your browser for a better reading experience.