Phase shift

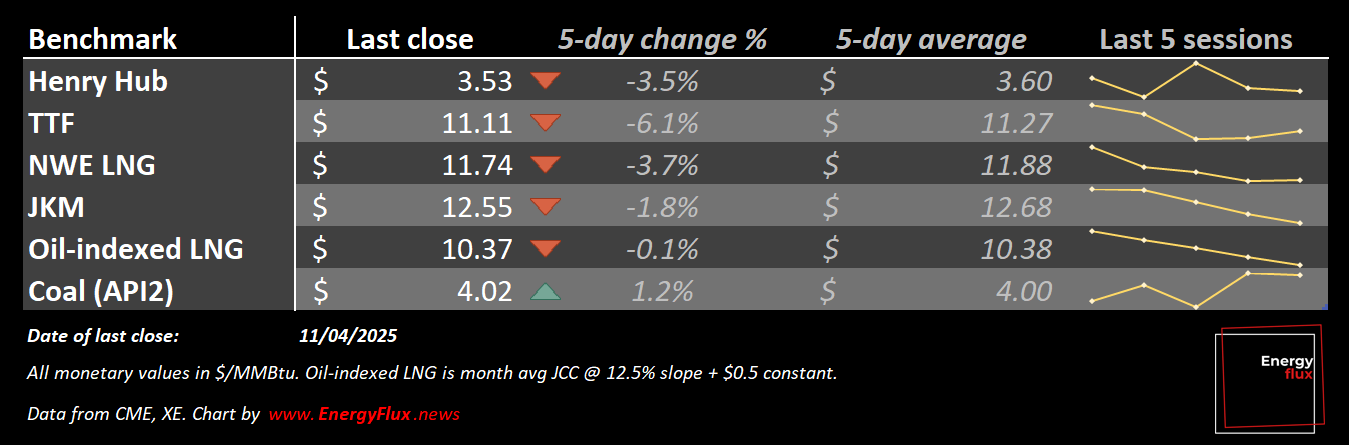

Bearish market reality bites, accelerating the onset of a new pricing regime | EU LNG Chart Deck: 17 April 2025

We are past the point of no return. The European natural gas market has shifted definitively into a new pricing regime. By extension, so has the global LNG market.

There were plenty of warnings of over-supply, hubris, imbalance and correction throughout 2024. One after another, these prophecies are starting to come true.

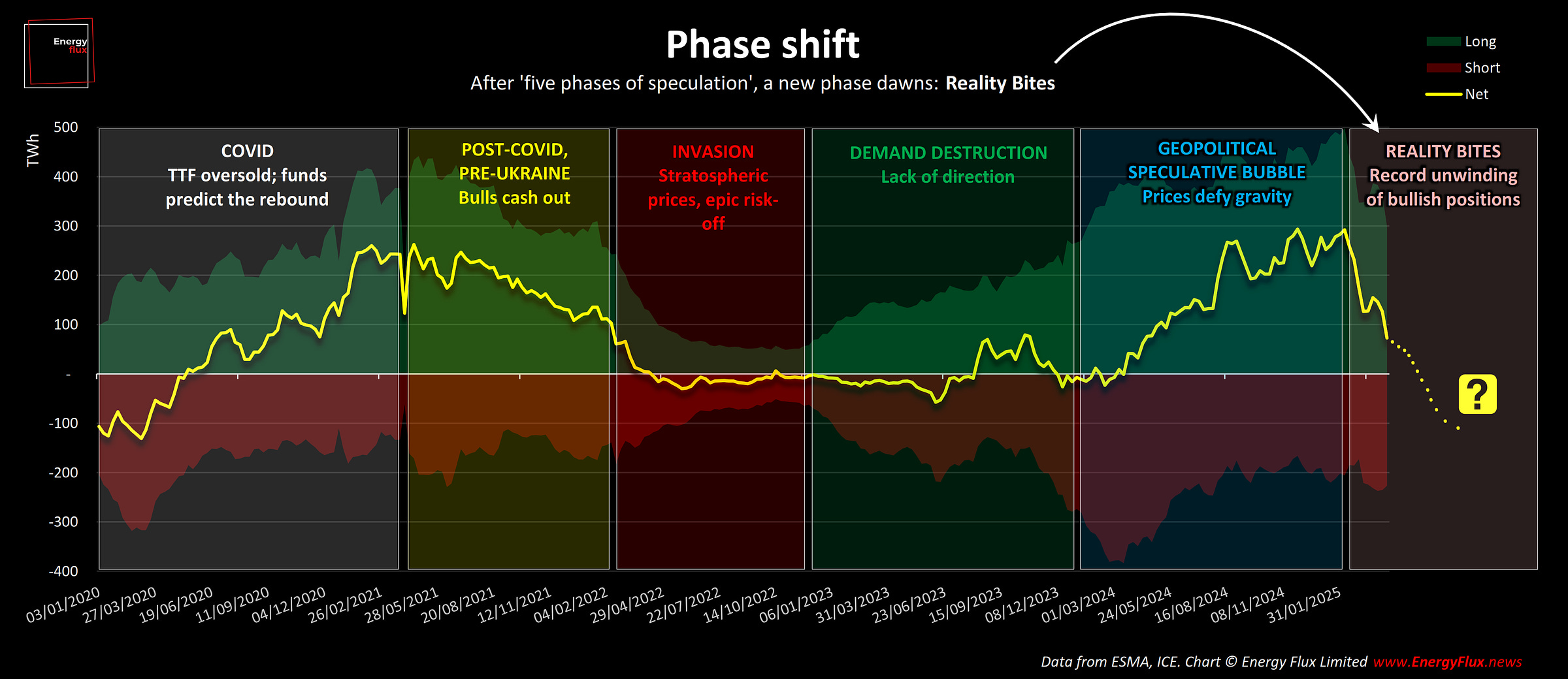

As usual, movements in speculative capital — investment funds shifting their price bets — provide the best explanation of market momentum.

The sell-off on the Dutch Title Transfer Facility (TTF) since February has been so deep and so fast that investment funds have neither the means nor the motivation to rebuild a bullish narrative.

The figures are quite astonishing. Since mid-February, hedge funds sold off a staggering 220 TWh of net length in TTF futures, or 75% of their total net position.

That’s equivalent to 22.5 Billion cubic metres (Bcm) of gas, or the equivalent of the entire annual gas consumption of Poland — gone in just nine manic weeks of trading.

Over the same time period, front-month TTF has fallen by about 40%.

The exodus of speculative capital from TTF length began after TTF reached its winter peak of €58/MWh in February.

It then accelerated as the Trump regime clumsily declared a trade war against the whole world, and then mostly against China.

TTF subsequently crashed haphazardly through supports as funds intensified their selloff, settling at a nine-month low of €33/MWh last Thursday.

In January, Energy Flux defined ‘five phases of speculation’ that characterised the EU gas market over the past five years. Since then, it has become apparent that a sixth phase is already upon us.

Speculative capital flight and price action have made it impossible to ignore: the ‘Geopolitical Speculative Bubble’ that started in February 2024 has burst. We are into a brave new pricing regime.

This week’s Easter special EU LNG Chart Deck explores how a confluence of bearish factors (on both demand and supply sides) will prevent a convincingly bullish narrative from taking root throughout summer 2025 — or, indeed, for some time thereafter.

If you want to understand the significance of recent price action — and the reasons why the market won’t return to the insane highs of 2024 — this post is for you.

Subscribe now for full access, and support independent market analysis that dares to make the bold calls that mainstream outlets can’t or won’t.

💥 Article stats: 1,800 words, 8-min reading time, 14 charts, graphs and animations 💥