Out on a limb

European gas markets price in supply disruptions that might not happen. A steep correction is long overdue | EU LNG Chart Deck 5-9 August 2024

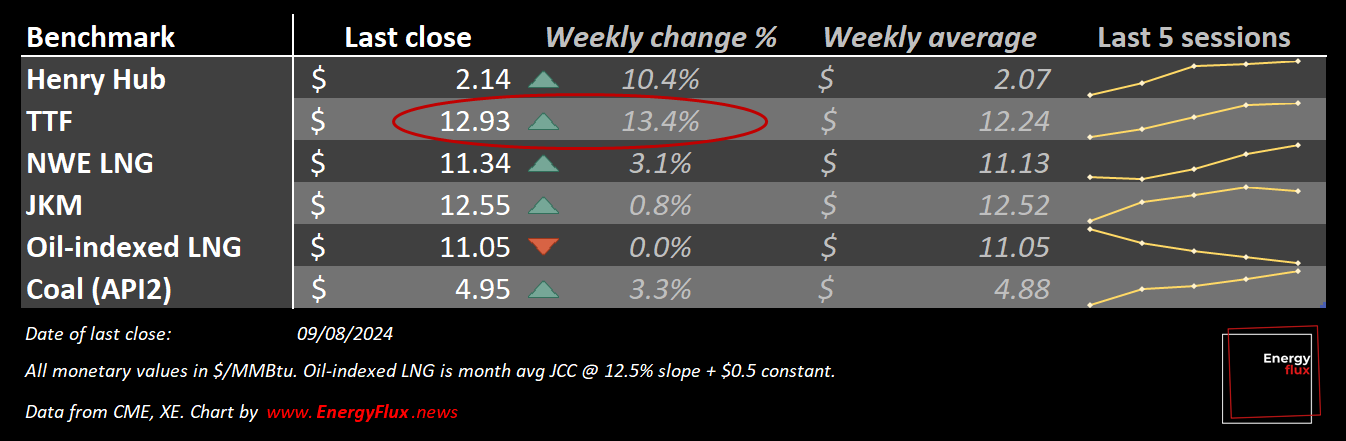

For anyone doubting the influence of speculative capital on European gas prices, the events of the last fortnight — and the dashboard above — should offer pause for thought.

In the week ending 2 August 2024, hedge funds amassed their largest net long position in Dutch TTF futures since Russia’s full invasion of Ukraine.

At the same time, the front month contract on the European gas benchmark climbed to its highest price so far this year — far outstripping movements on other major hubs and indexes.

The bull run is a speculative bet on supply-side disruptions that are by no means guaranteed to happen.

This week’s EU LNG Chart Deck explores how hedge funds are positioning in response to geopolitical events — priming European wholesale gas prices for what could be a spectacular autumn correction.

Article stats: 1,500 words, 7-min reading time, 10 charts and graphs