Fever pitch

Market uncertainty is reaching 2022 proportions, but not all risks are being priced equally | EU LNG Chart Deck: 25 November 2024

“Be greedy when others are fearful, and fearful when others are greedy.”

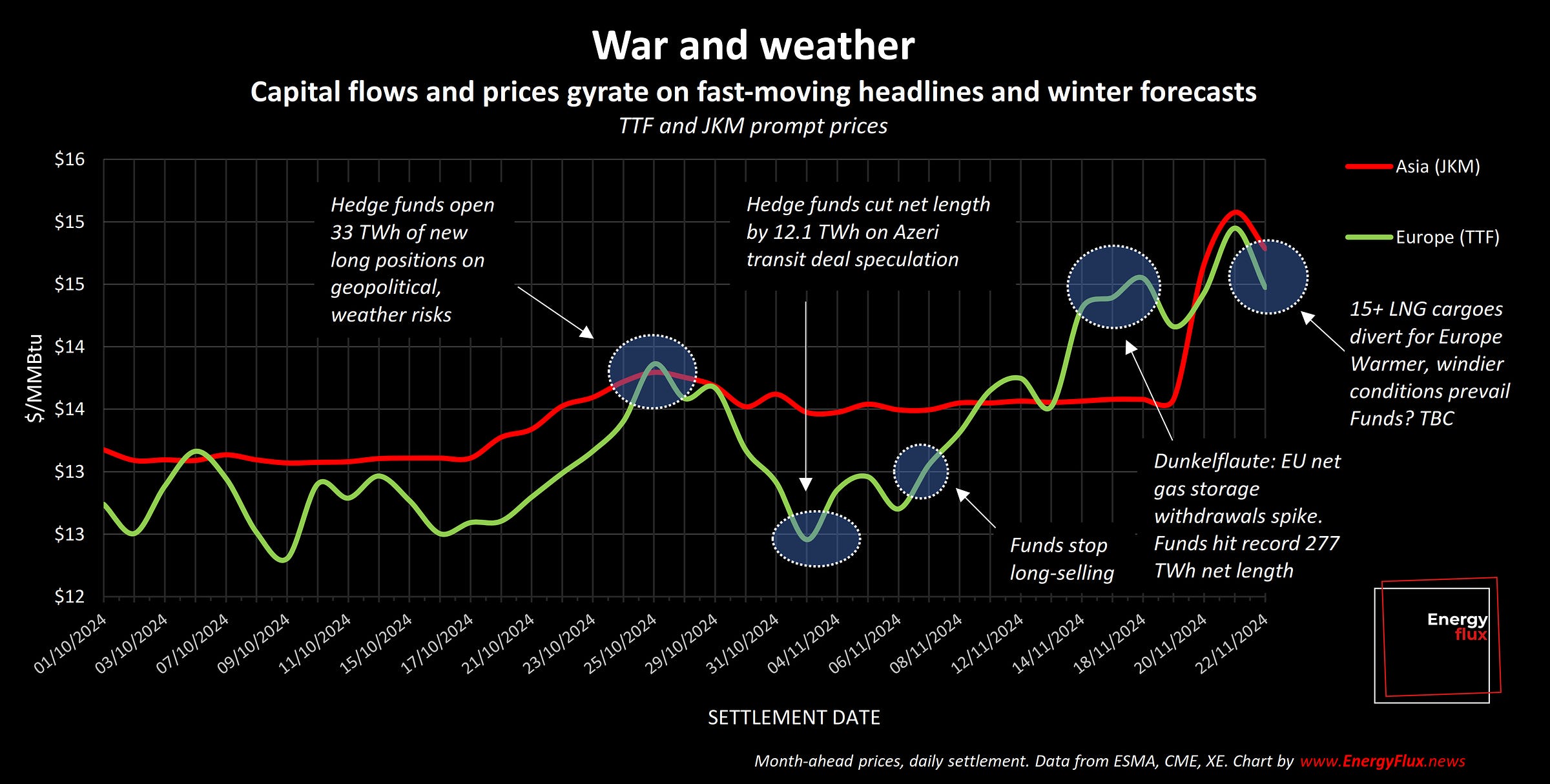

Warren Buffet’s old investment maxim is struggling for relevance in Europe’s frayed gas market. Greed and fear are becoming indistinguishable amid an accelerating geopolitical news cycle that is heaping fresh uncertainty onto an already delicate winter outlook. Investment funds see mostly upside risk from the increasingly volatile situation in Ukraine, and are positioning accordingly. But there could be a sting in the tail.

FREE ARTICLE: 1,800 words, 8-min reading time, 13 charts and graphs

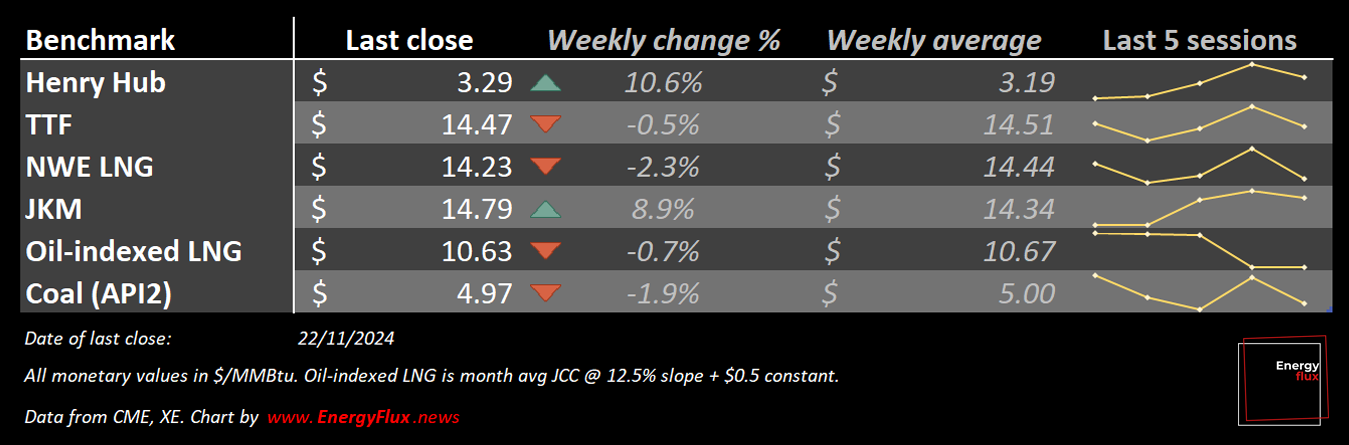

Geopolitics and weather events are driving wild price swings. Dutch TTF, the European gas benchmark, traded within a whisker of €50/MWh ($15.24/MMBtu) on Friday before slumping below €47/MWh ($14.30/MMBtu). The front-month contract (Dec-24) has gained 20% since the start of November.

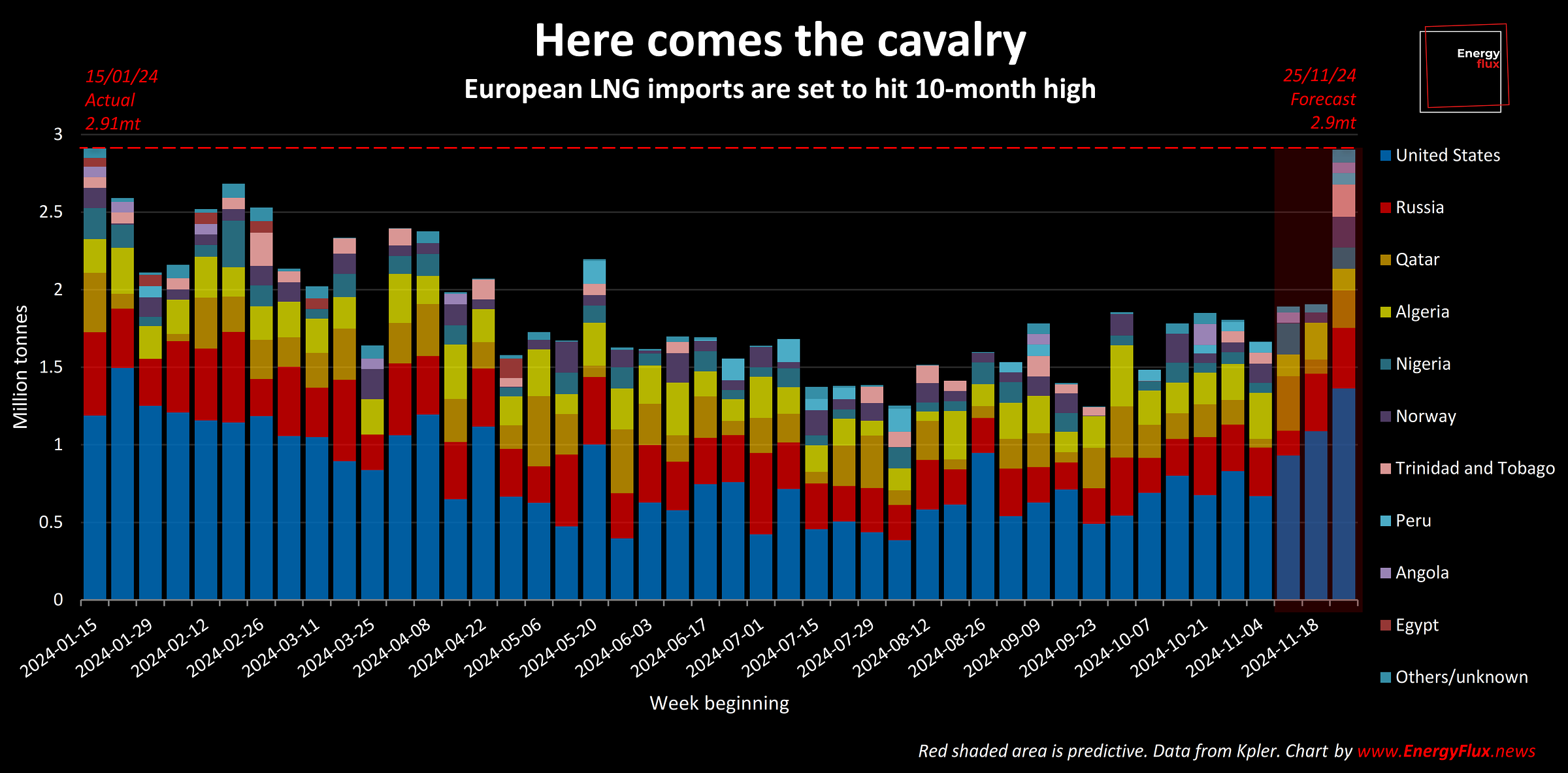

The recent cold snap spiked prices, pulling an armada of Asia-bound liquefied natural gas (LNG) carriers towards Europe. European LNG imports will hit a ten-month high this week, according to Kpler.

The imminent LNG arrivals, combined with the onset of milder windy conditions across the region, helped loosen the EU gas market towards the end of a rollercoaster week.

And what a week it was. In a clear sign of intensifying volatility, the Intercontinental Exchange (ICE) on Thursday hiked margin rates by as much as 23% on TTF gas futures. The move aims to mitigate counterparty risk by ensuring traders can cover potential losses arising from extreme price movements.

The timing was judicious. Outgoing US president Joe Biden’s recent decision to allow Kiev to use American missiles to strike military targets inside Russian territory paved the way for a dramatic escalation in the conflict, rattling energy markets.

Russian forces responded by bombarding Dnipro in eastern Ukraine using a frankly frightening new missile codenamed “Oreshnik” (the hazel).

Hours later, the US Treasury slapped sanctions on Gazprombank — the entity used by European gas buyers to pay the Russian exporter and circumvent Vladimir Putin’s edict that transactions are realised in roubles.

Exquisite choreography

Why did the White House wait until now to do this? The recent sequence of events seems well orchestrated.

Until now, Gazprombank had been excluded from Western sanctions to avoid hurting European allies. But after Gazprom ceased gas supply to Austria’s OMV, commercial ties with the most ‘Western friendly’ buyers of Russian gas were (to all intents and purposes) severed.

This opened the door to a sanctions package targeting Russia’s largest remaining non-designated bank, as well as dozens of other financial institutions and officials in Russia.

Gazprom still has active supply agreements with Slovakia and Hungary — the EU member states most sympathetic to Russian interests. China is also a major buyer of Russian gas via the Power of Siberia pipeline.

The impact of OFAC’s intervention on these transactions is not yet clear.

Transits tragicomedy

The move certainly complicates efforts to sustain Russian gas transits through Ukraine after their interconnector agreement expires at the end of this year. Transacting with Russian gas after the sanctions come into effect in December risks exclusion from the US financial system.

Azerbaijan’s state oil company SOCAR — which has positioned itself as a potential transit intermediary — is a major beneficiary of Wall Street largesse.

SOCAR received ~$6.8 billion in financing between 2021 and 2023, with approximately $2.8 billion sourced from JPMorgan Chase and Citigroup. It also works with US firms such as KBR on Azeri energy projects in the Caspian Sea.

Facilitating gas transits would burnish Azerbaijan’s relevance to both Europe and Russia. Baku must decide whether it is worth risking Western partnerships for the leverage this bestows.

However, state apparatchiks in Moscow have proven adept at devising workarounds to Western sanctions. Is there any reason to believe this time will be different?

Stealing the show

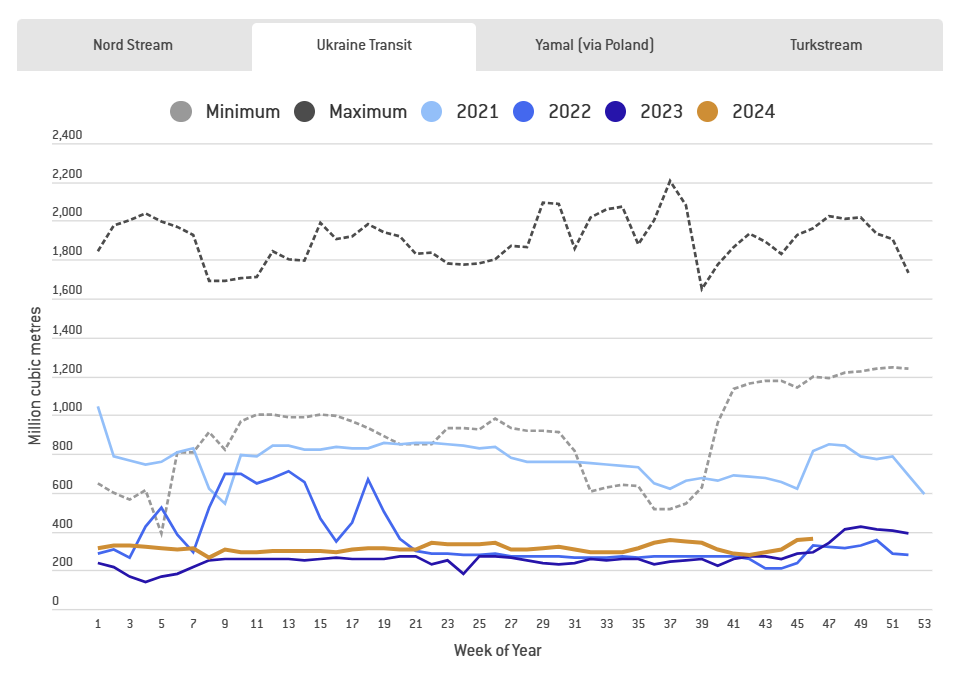

The amount of ink spilled about Russia’s remaining gas transits is disproportionate to its significance in the grand scheme of Europe’s energy system.

Flows via Ukraine have risen slightly since the summer to roughly 360 million cubic metres per week (50 MMcm/d), or ~6% of total imports.

Still, the potential loss of this gas in the depths of winter (or earlier) has kept the market on edge all year. The flash-crash in September — triggered by a fake news story about a done deal on Azeri gas swaps — was revelatory.

Funds mobilised

Against a deteriorating geopolitical backdrop and with asymmetrical information warfare in full swing, speculation around a transit renewal is at fever pitch — both figuratively and literally.

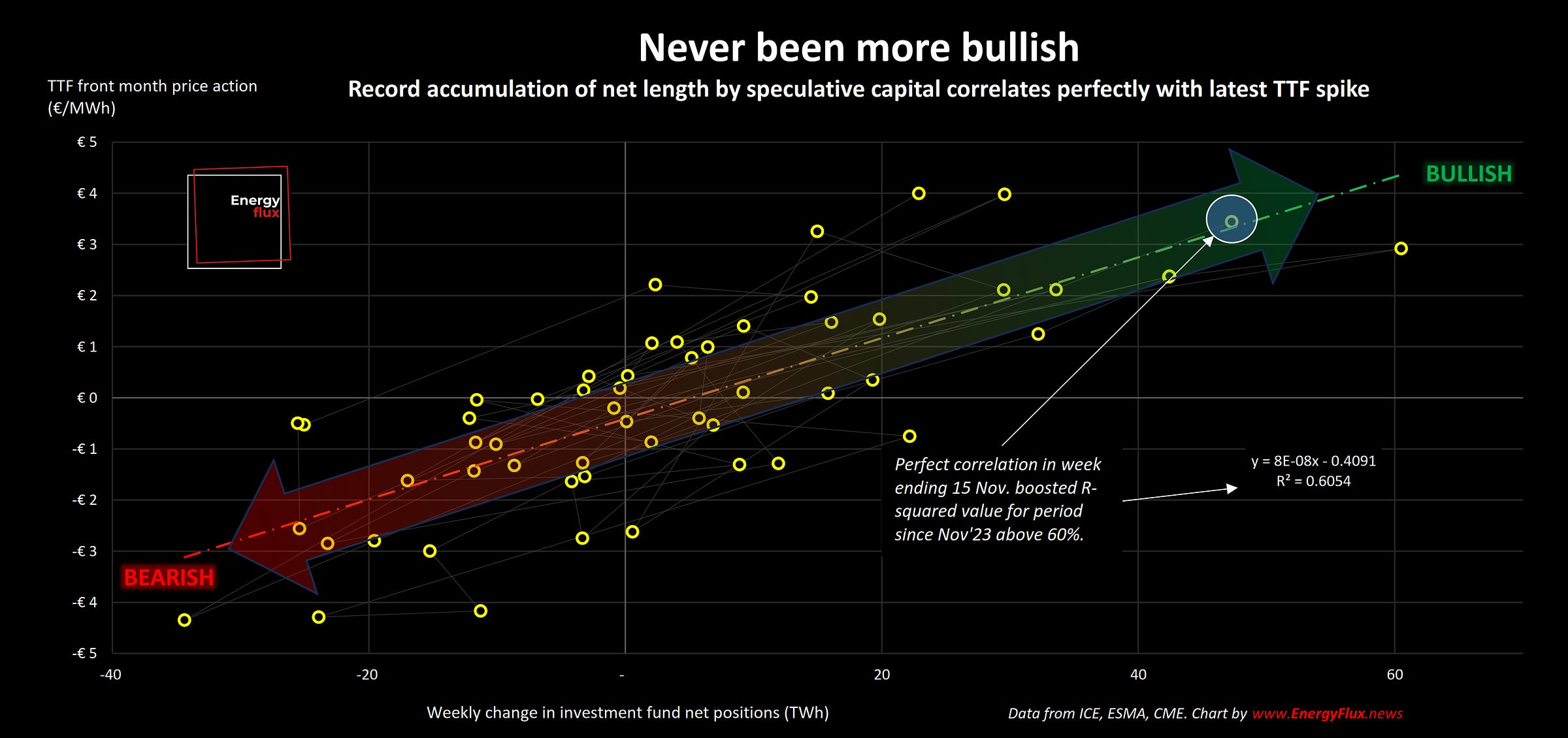

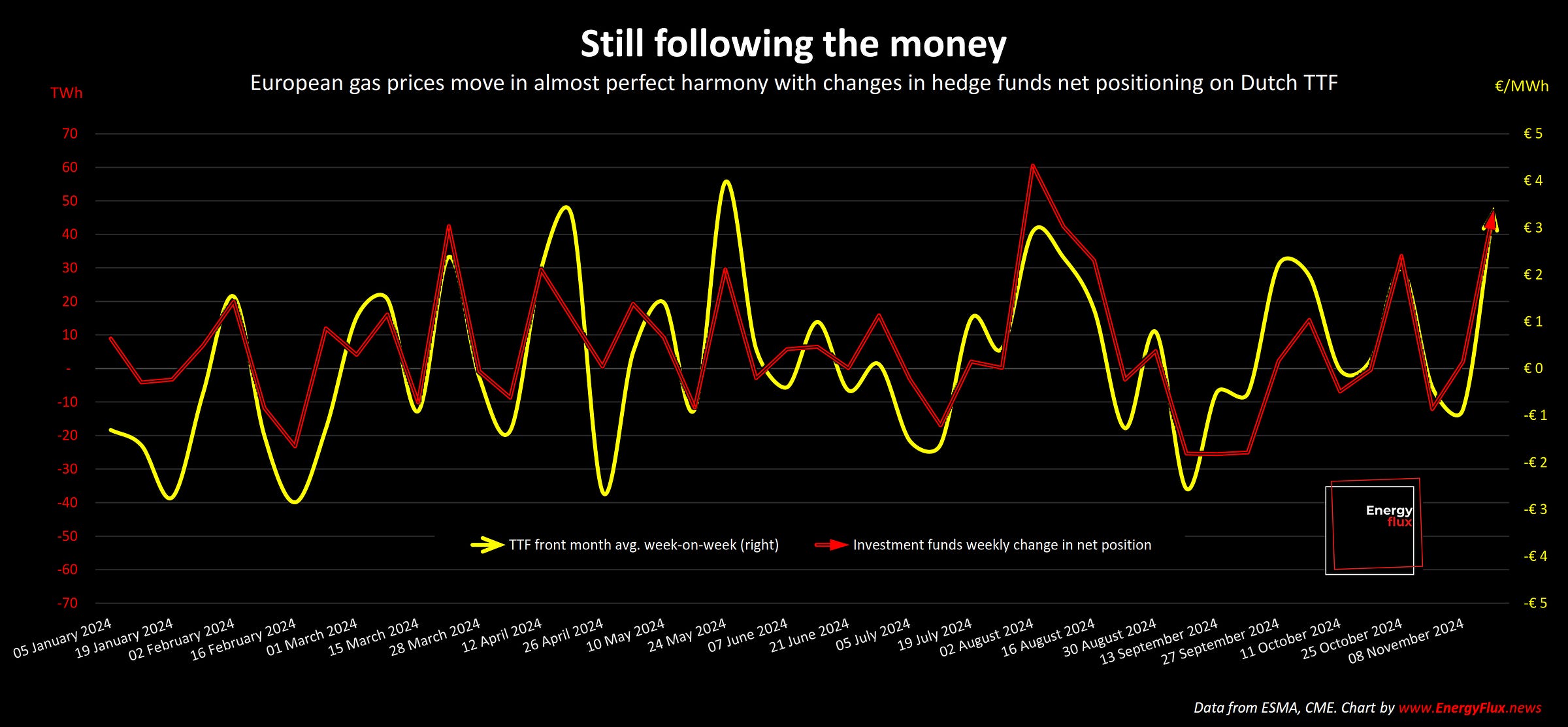

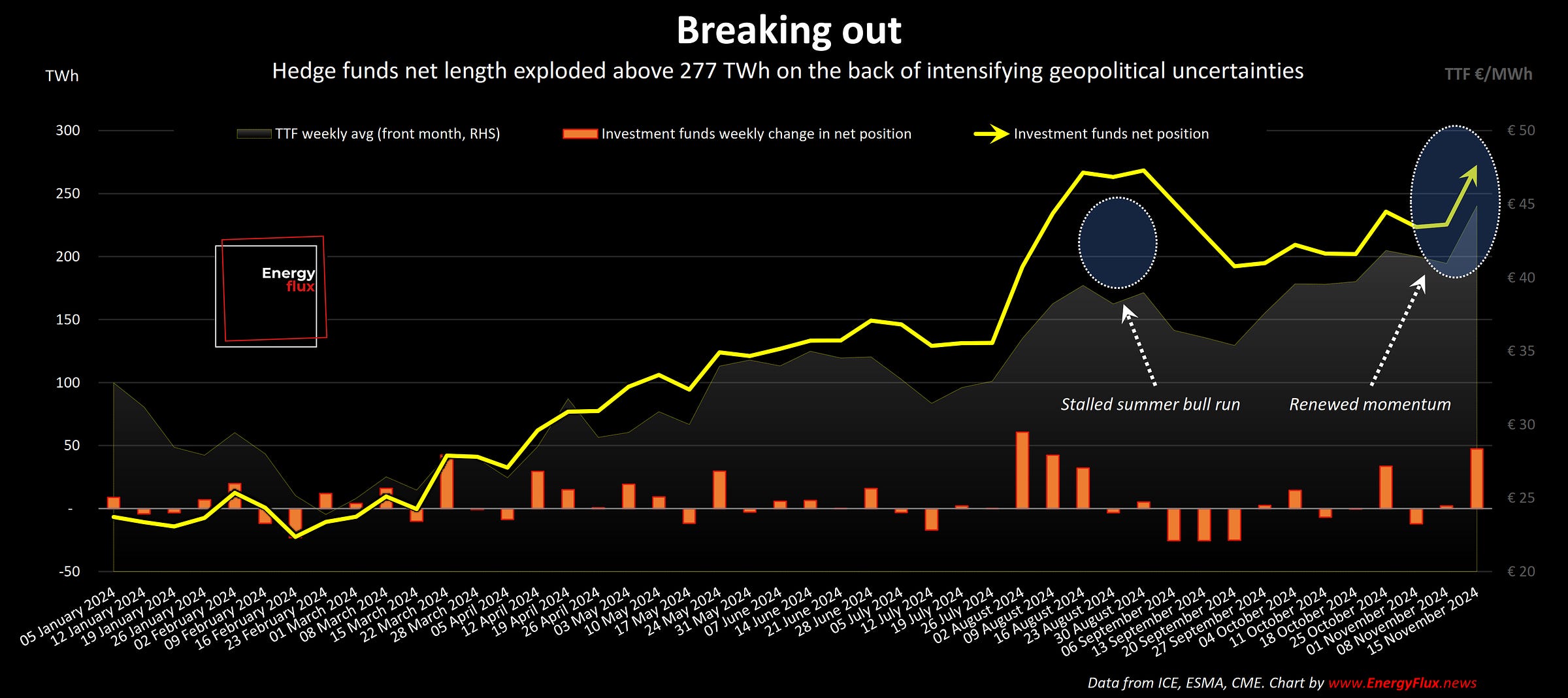

In the week ending 15 November, speculative capital extended its net length in TTF futures to a record 272 TWh. This coincided with a €3.44/MWh increase in the average weekly price of front-month TTF, producing this sublime correlation in the TTF Sentiment Tracker:

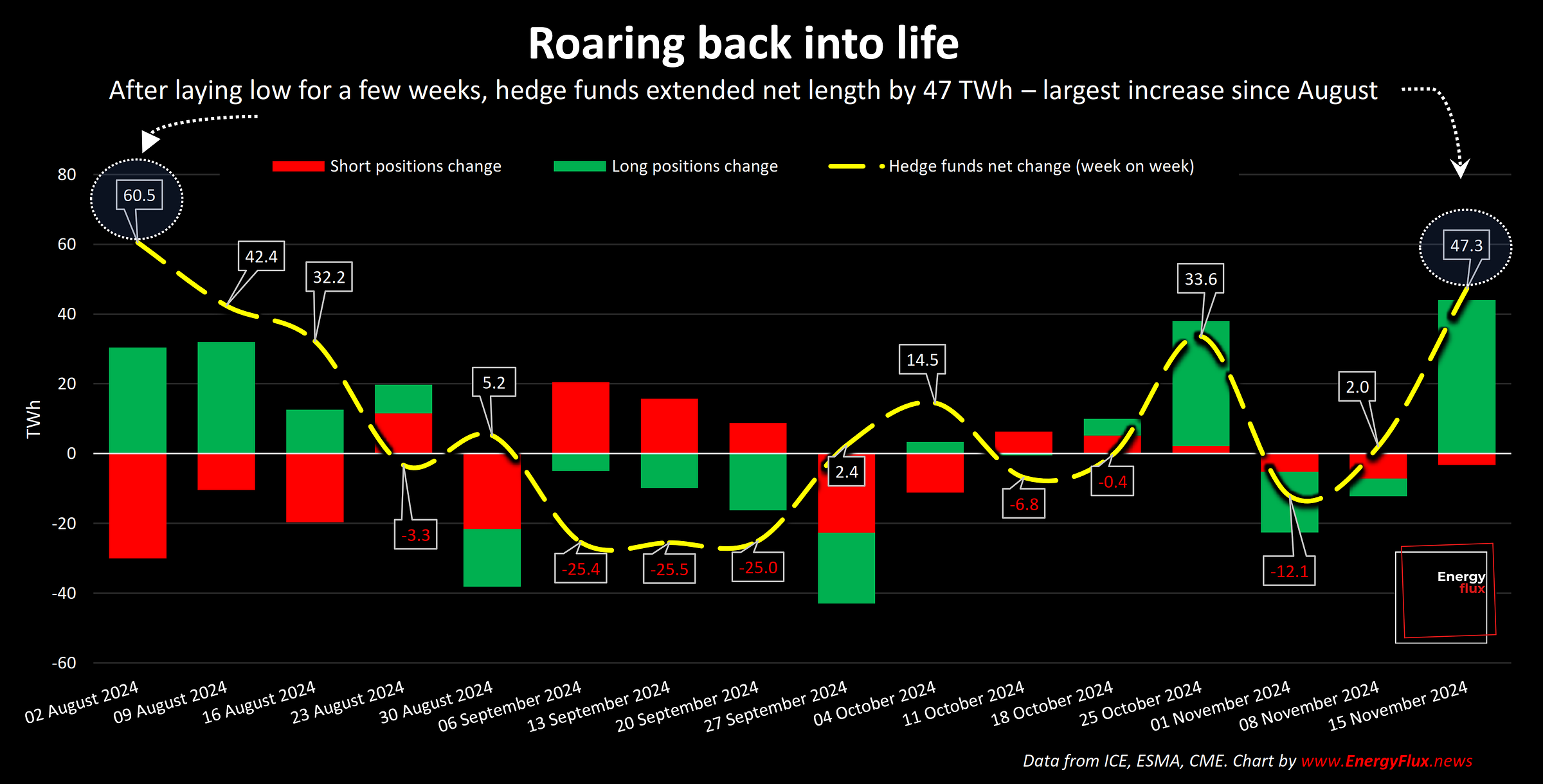

Hedge funds added a mammoth 47 TWh of net length to their already-bloated bullish position, marking the largest net addition since August.

The impact on price action was unmistakeable.

Funds’ accumulation of net length in August can now be seen for what it was: a premature attempt to spark a fresh rally.

The brief correction in September had all the hallmarks of a sea-change in direction and sentiment. But the bulls, it turns out, were merely limbering up.

The cold snap following the US election was all they needed to spark a fresh wave of panic-pricing to push TTF to successive 2024 highs throughout November.

Taking the under

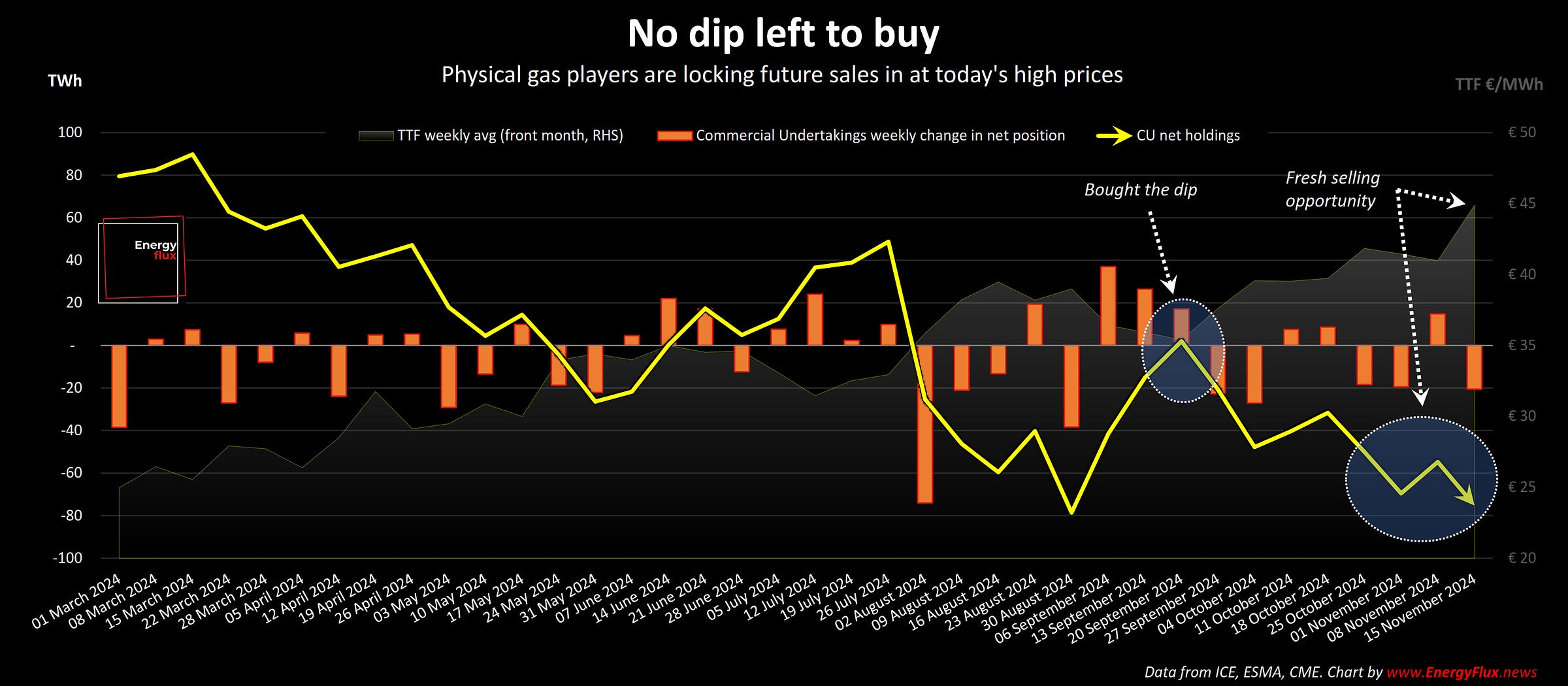

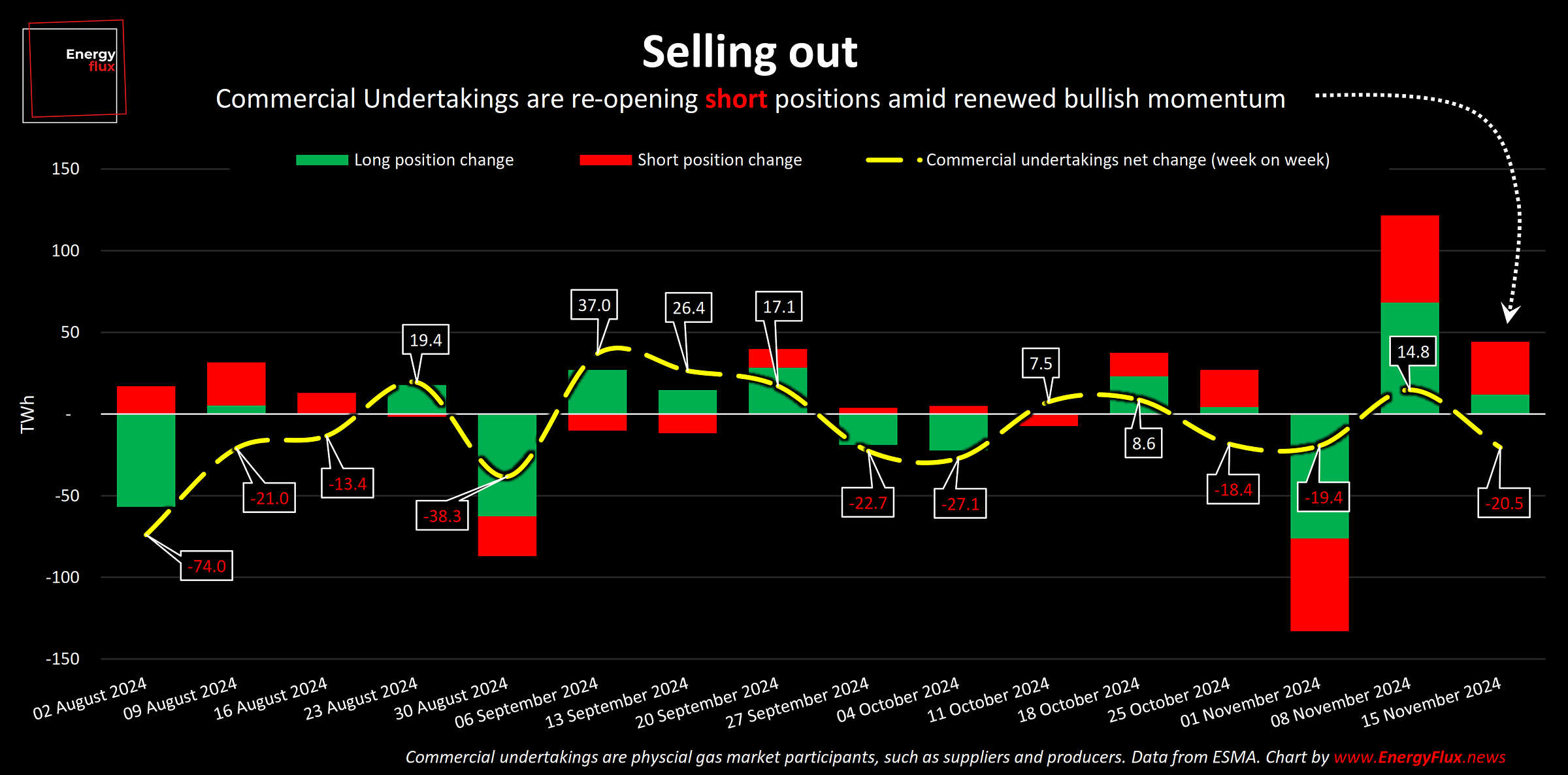

On the other side of the trade are the ‘commercial undertakings’. The physical players always mirror the funds, and they duly embarked on a fresh selling streak to reinvigorate the 2024 rally…

…opening 87 TWh of new short positions in the last two weeks.

Liquidity draw

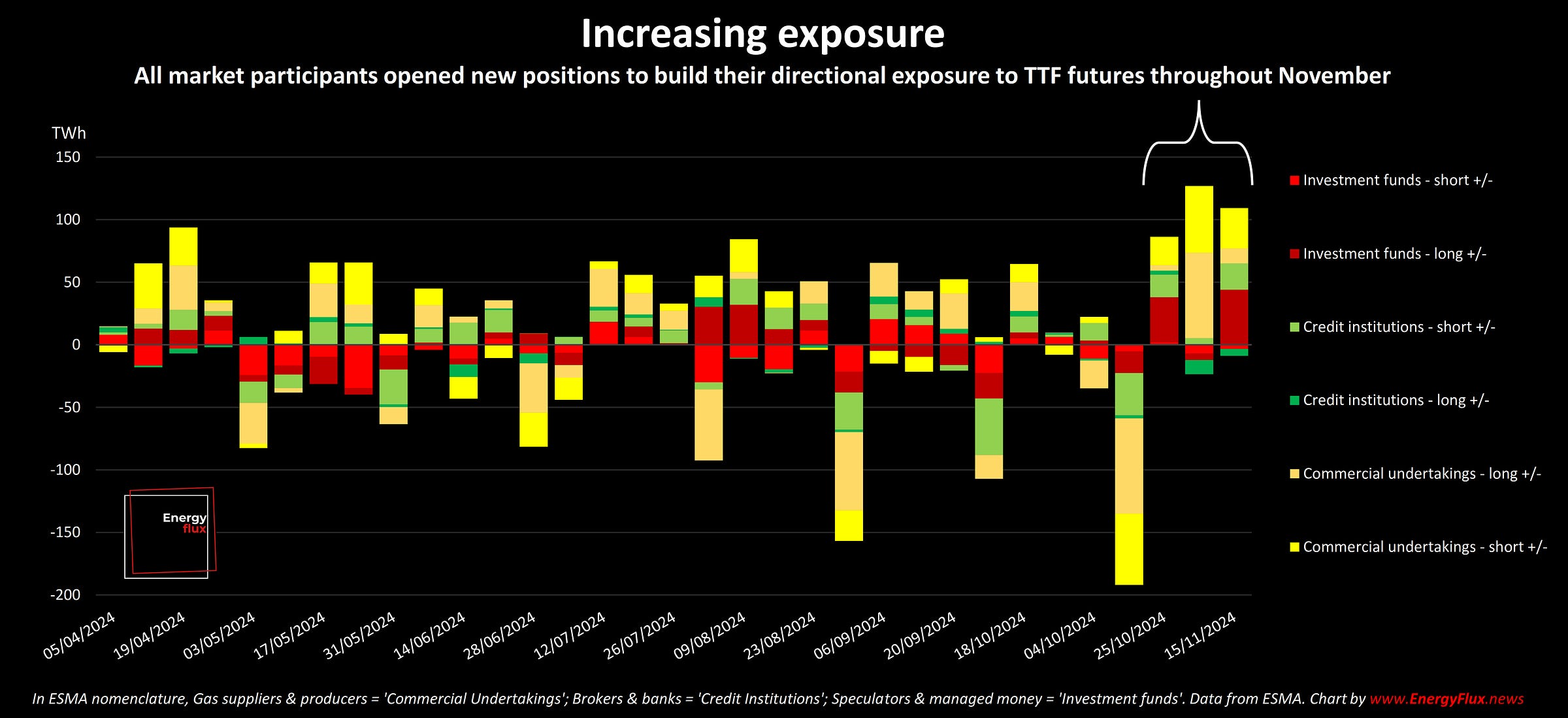

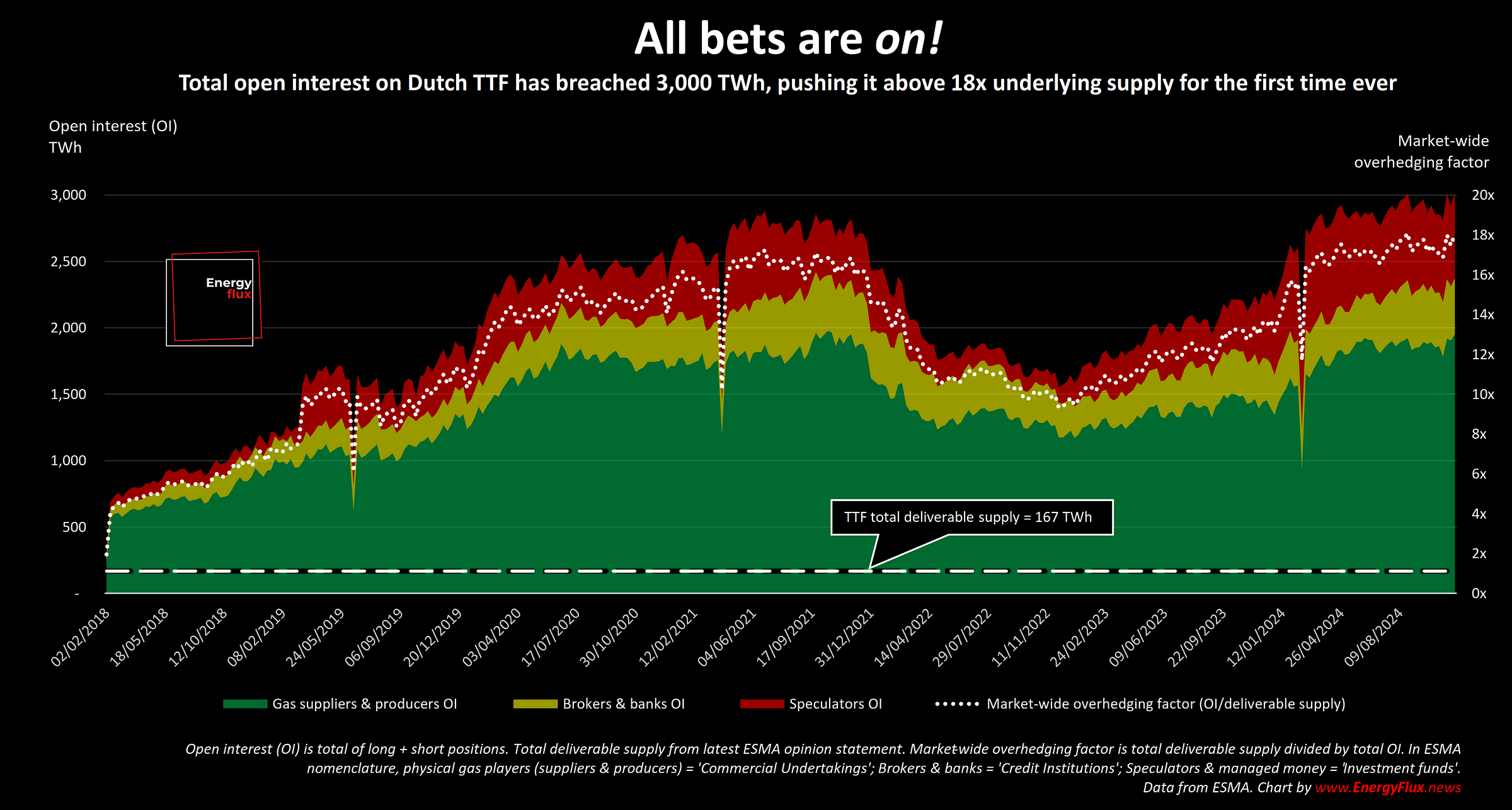

Periods of extreme market uncertainty and volatility are often characterised by a drop in liquidity. Not so this winter.

The last month saw a notable increase in exposure of all market participants to TTF futures…

…boosting overall liquidity on TTF to record levels.

ICE’s decision to increase TTF margin rates might nudge some participants out of the market. The Dutch trading hub can certainly afford to lose some speculators.

Imagine a hypothetical mid-sized hedge fund with €500 million assets under management (AUM). The fund might hold 1,000 front-month TTF contracts with a total notional value of €36.5 million.

The increase in the margin rate (from 6.9% to 8.3% for Dec-24) requires roughly €500,000 additional collateral. Assuming the fund allocates 5% of its AUM for margin and collateral purposes, the extra margin requirement represents ~2.2% of its liquidity buffer.

Given the profound uncertainty gripping the market, the fund might opt to close out its position and await new information.

Too many narratives, not enough facts

The stories being told to justify elevated prices are a poor substitute for hard facts. Nature abhors an information vacuum, filling it with crisis narratives designed to inflate prices. New information tends to do the opposite.

The brief cold snap triggered a clamour of doom-laden op-eds about Europe’s next energy crisis. There was less commentary about the price-cooling effect of the massive response from LNG traders to European price signals.

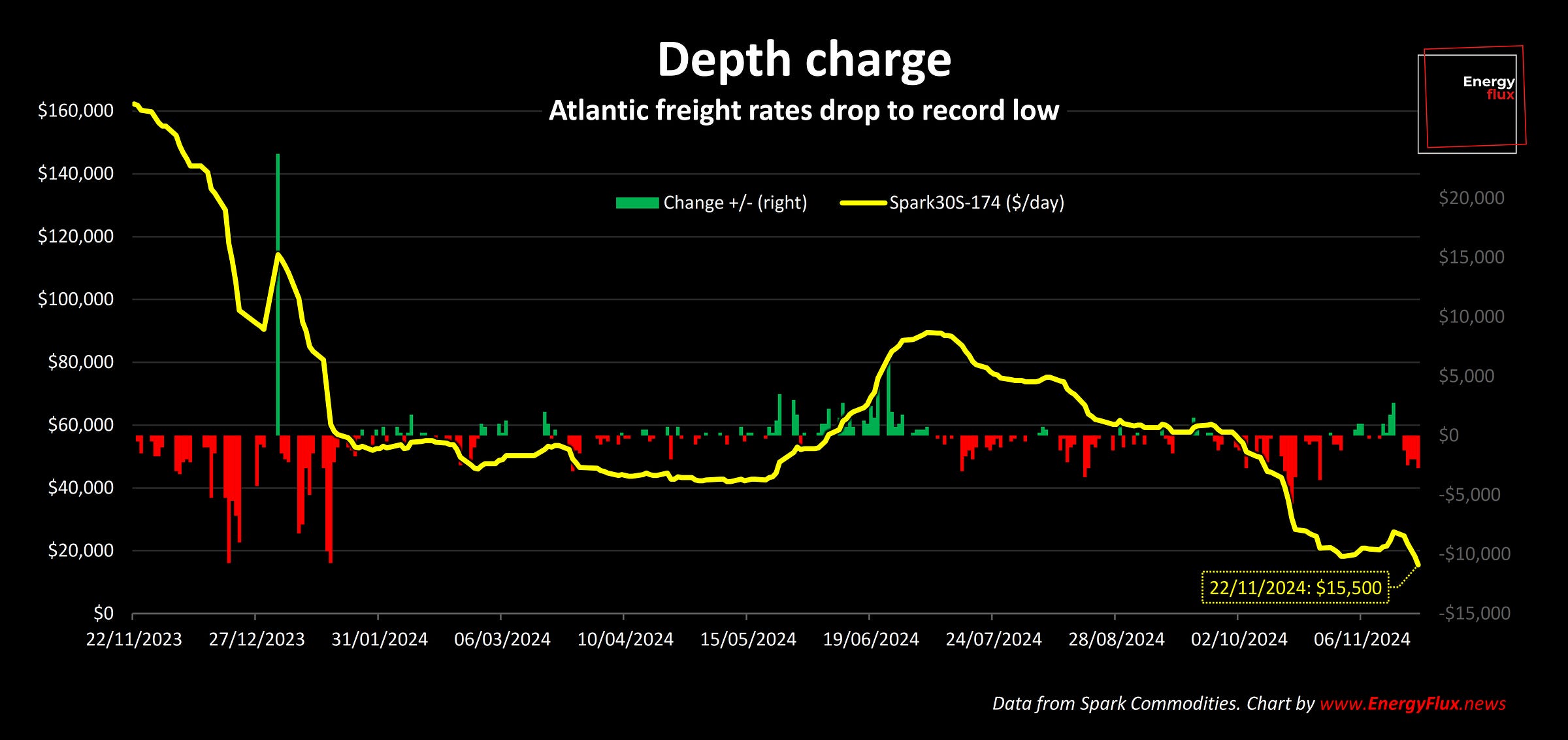

Europe has a proven ability to keep Asia-bound spot LNG cargoes in the Atlantic basin. Testament to this are LNG vessel freight rates, which hit rock-bottom last week.

The Spark30S Atlantic rate fell to $15,500 per day on Friday, the “lowest assessment on record,” according to Spark Commodities commercial analyst Qasim Afghan, who told Energy Flux:

“US vessels diverting from Asia to Europe means a reduction in tonne miles, and hence a greater supply of vessels in the basin. A greater amount of vessels staying within the Atlantic works to drive down freight rates in the basin.”

Not all risks are priced equally

Cratering freight rates and low utilisation metrics are also an indicator of fundamentally weak commodity demand, as detailed in a recent Deep Dive. This reality is not reflected in current prices.

The potential loss of Russian gas transits, on the other hand, has been priced in several times over. This is the biggest fact-free gas narrative doing the rounds right now.

If bullish risk factors have been double/triple/quadruple counted already, there is huge potential for the market to ‘sell the news’ hard on New Years Day. If Q4’24 was the bullish party, Q1’25 will be the bearish hangover.

‘Nice pipelines you got there’

Yes, Ukraine insists it will not renew the interconnector agreement. But if Russian gas stops flowing though Ukrainian pipes, what would protect that infrastructure from Russian air strikes?

Ukraine’s expansive network of pipelines and compressor stations have been largely spared in two-and-a-half years of unrelenting bombardment of Ukrainian energy infrastructure. If Kiev vetoes a renewal, the unspoken pact of ‘carry my gas and I don’t bomb your pipes’ would vanish.

Another last-minute transit deal cannot be ruled out. The same thing happened in 2019, when the EU stepped in at the eleventh hour to broker a five-year renewal. That was five years after Russia annexed Crimea.

It has now been a decade since the annexation. After everything that’s happened since then, Kiev’s acquiescence to ongoing transits would speak volumes about Ukraine’s vulnerable position – and Europe’s profound failure to present a cohesive front against Russian aggression.

Amid all the fake news, misleading leaks and gnashing of teeth, there is one constant factor that should guide thinking on this topic: Europe’s seemingly unlimited capacity for internal division and capitulation in the face of external threats. The story of Russian gas in Europe is far from over.

Seb Kennedy | Energy Flux | 25 November 2024

More from Energy Flux:

Canary in the coalmine

Liquefied natural gas saved Europe in 2022. Now, the LNG industry needs to save itself.

Geopolitics turns bearish

Bullish momentum has once again overwhelmed European gas markets. But this time the rally has nowhere to go, not least because geopolitical events – so often the clarion call of EU gas permabulls – are now conspiring to crash the market.

The mask slips

Anyone labouring under the misconception that the European gas market is a bastion of analytical sophistication, prudent risk management and tech-savvy trading nous was abruptly relieved of that burden last week.