EU and US energy fortunes diverge, but for how long?

PLUS: Scientists debunk hydrogen ‘hopium’ + MORE

LEAD STORY: Europe and the US are facing very different energy markets this winter. Europe is exposed to global forces and geopolitical power plays, while the US is insulated by its huge shale production base. But political headwinds and low reinvestment rates are eroding America’s safety margin. That’s right here in this email 👇

BREAKOUT STORY: Oil and gas investment is simultaneously way too high and dangerously low. Irreconcilable energy and climate objectives are leading us towards a very messy transition. Click below to read more (5-minute read):

IN THIS EMAIL:

💥EU and US energy fortunes diverge, but for how long?

EU-Russia toxic co-dependency

Making LNG reliable

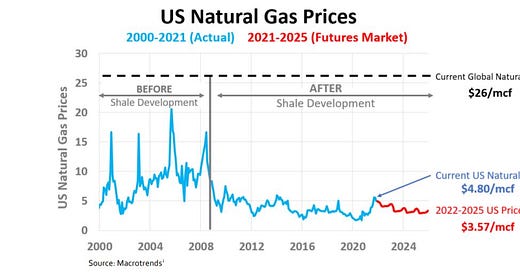

America’s shale shock absorber

💥Science-led group formed to debunk hydrogen ‘hopium’

🌎Global headlines by key topic (20+ links)

🧠‘The EU must regulate methane for imported oil and gas’

💥EU and US energy fortunes diverge, but for how long?

Wherever you dare to look, alarm bells are ringing in European energy markets. The amount of gas in underground storage facilities is running perilously low for this early stage of winter. A cold snap that coincided with another wind lull sent gas futures and carbon prices soaring to fresh records, harming businesses and the environment. Sweden, the poster-child of European decarbonisation, this week briefly fired up a very polluting heavy fuel oil power plant to help keep the lights on in Poland.

In Germany, the energy retail segment is starting to show the same cracks that caused a spate of bankruptcies in the UK. Several small gas suppliers have ceased trading recently: Gas.de last week terminated fixed price gas supply contracts across Rhineland-Palatinate which had been rendered loss-making by a 400% year-on-year “explosion” in wholesale costs.

That came after fellow suppliers Rheinische Elektrizitäts and Otima Energy went bankrupt, with the latter citing not only wholesale market turmoil but also the “elimination” of certain undisclosed power generators that it relies on to meet electricity distribution commitments.

Otima said it was unable to replace the lost generators, a problem that is presumably not going to disappear after Germany’s new coalition government agreed to accelerate the country’s coal exit to 2030 – eight years earlier than outgoing chancellor Angela Merkel’s policy. This new target, together with Germany’s nuclear exit, will leave a capacity deficit of 41 GW or more depending on the rate of heat and transport electrification, according to Timera.

The immediate crisis facing Europe’s winter energy supplies is a baptism of fire for the ‘traffic light coalition’ in Berlin, and casts a long shadow over its decarbonisation ambitions. December gas futures on Dutch hub TTF rose 40% in November, dragging German baseload power up 53%, according to Swiss energy trader Axpo. Maintaining focus on 2030 is tricky when so much could go wrong between now and February.

Andy Sommer, an analyst at Axpo, said in a note that the early cold snap, combined with low generation from wind, hydro and French nuclear, will prolong the call on coal-fired power plants – with implications for EU carbon prices: