The storage-speculation nexus (part 2)

DEEP DIVE: Data analysis reveals how hedge funds are positioned to exploit lax regulation and profit from EU gas storage targets

Anyone hoping that savvy EU regulators might step in to calm jittery European energy markets was sorely disappointed last week. The European Commission, in its infinite wisdom, introduced intermediate natural gas restocking targets that added fuel to the fire of bullish bravado raging in the winter gas market.

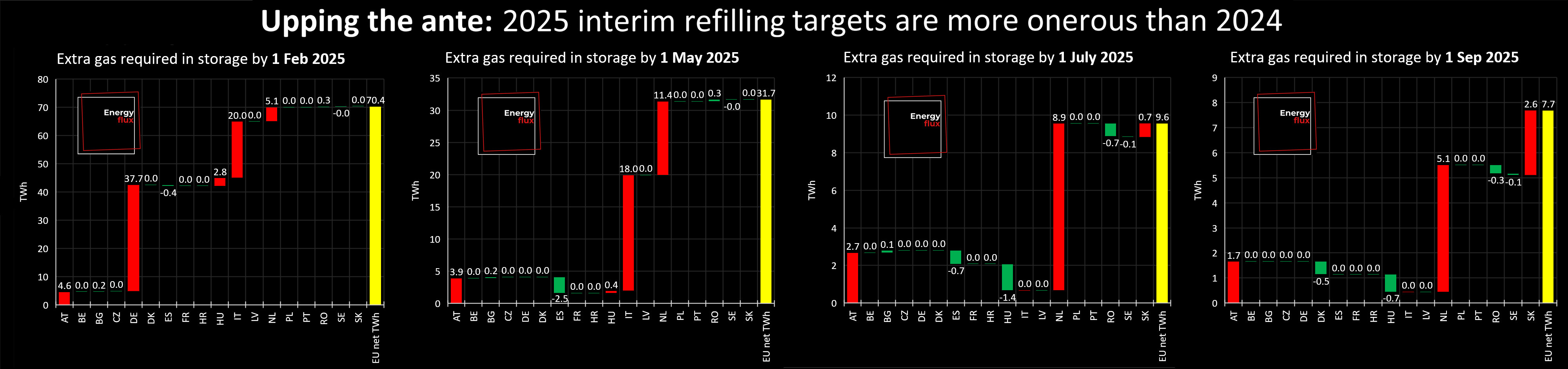

The new refilling targets for 1 February, 1 May, 1 July and 1 September 2025 are significantly higher for a select few countries compared to previous targets for the same dates in 2024.

Depending on how winter plays out, this could place additional burden on storage operators to procure more gas during the coldest months of the year — and potentially without any contribution from Russian pipeline transits via Ukraine.

Market reaction was instantaneous: prices on Dutch TTF, the EU gas benchmark, leapt by as much as €1.4/MWh (+3%) when the announcement dropped around midday on Friday. The prompt contract (Jan-25) has retained those gains so far this week. Traders evidently spy an opportunity to corner captive buyers.

The implementing regulation states, without irony, that these targets are designed to avoid any “distortive impact on the proper functioning of the internal market in gas, including in gas derivatives markets”.

Speculator’s charter

The impact of the EU’s rigid gas storage mandates is twofold.

One is the message it sends. The supply-demand balance is deemed to be tightening, adding credence to the bullish narrative that’s captivated market sentiment for most of 2024. Market reaction on Friday attests to that.

The other is the market power it bestows upon speculators. An obligation to hit an arbitrary fill level turns strategic storage operators (SSOs) into easy targets for investment funds, as explored by Energy Flux in August (see The Storage-Speculation Nexus, Part 1).

However, the available data is inadequate to substantiate that assertion.

The Commitment of Traders report for ICE Endex TTF shows only the aggregate number of long and short positions held by investment funds in all TTF futures; it does not reveal how these positions are distributed among the various calendar month/season futures with differing maturities.

Fund positions revealed

Today, that changes. New data analysis by Energy Flux provides original insight into where investment funds are most likely focussing their bullish bets.

Using regression analysis, it is also possible to observe how this has evolved over the last two years.

This Deep Dive explains the data analysis methodology and its findings in full. The main takeaway is that hedge funds are clearly seizing the opportunity presented by the gas storage mandate.

If you trade TTF futures, manage EU gas-related risks or have any exposure to TTF price movements, then you need to understand how hedge funds are positioned for the months ahead.

The European Securities and Markets Authority (ESMA) holds data on precisely how funds are positioned, and the trading strategies they employ. In the name of commercial confidentiality, it does not publish this data.

This post – the second in a three-part series – lifts the corner of that veil:

- Part one identified the possible link between storage targets and speculation (August 2024)

- Part two (this post) uses regression analysis to prove the storage-speculation hypothesis (December 2024)

- Part three uses the same technique to dissect the Q1 TTF selloff and assess seasonal price risk for 2025-26

Subscribe now for full access.

ARTICLE STATS: 2,300 words, 11-min reading time, 7 charts & graphs, 1 data animation

Member discussion: The storage-speculation nexus (part 2)

Read what members are saying. Subscribe to join the conversation.