Sell the rumour…

…buy the news? | EU LNG Chart Deck: 18 February 2025

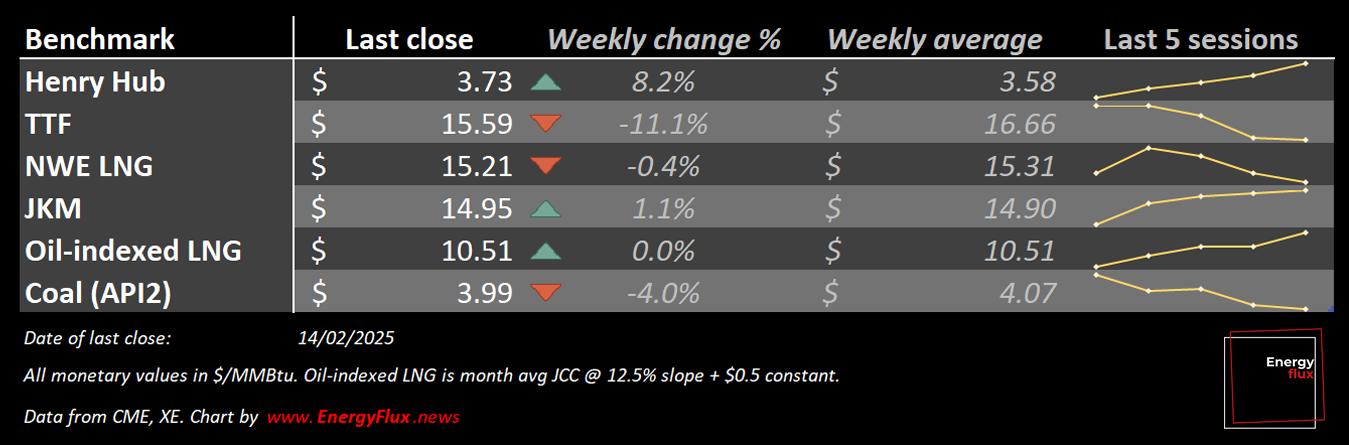

European natural gas prices are at an inflection point. Tectonic shifts across the regulatory and geopolitical landscape are — finally! — starting to deflate the bloated risk premium and correct the inverted summer-winter spread.

But with traders seemingly giving credence to unconfirmed bearish news, there is potential for a rebound if the downside risks that triggered the selloff fail to materialise.

Speculation is swirling around the potential for a Trump-brokered Ukraine peace settlement to pave the way for a resumption of Russian pipeline gas imports into central and eastern Europe. Less likely, but not impossible, is a relaxation of Western sanctions against Russian LNG as a bitter sweetener for the Kremlin.

At the same time, member states are now speaking openly about the need to relax the EU’s 2025 summer gas storage refilling targets. They have woken up to the market-distorting effects of the inflexible mandate to hit 90% by 1 November.

Relaxing or removing the regulation could trigger investment funds to sell down most if not all of their enormous 292 TWh net long TTF position.

However, neither of these eventualities — relaxed storage regulations or a return of Russian gas — is guaranteed to prevail.

The more that the market softens or trades sideways on the assumption that they are, the greater the risk of an inverse ‘buy the rumour, sell the news’ event later in the year.

This risk could become acute if heatwaves send cooling demand surging across densely-populated Asian economies, triggering a summer tug-of-war for cargoes in the refilling season.

This week’s EU LNG Chart Deck runs the rule over market reaction to recent (geo)political developments and how this has altered:

💥 JKM-TTF spread & US-Asia LNG arbitrage

💥 LNG netbacks to Europe from global FOB export locations

💥 TTF summer-winter seasonal spread & term structure

💥 Near-term directionality ahead of new price regime in 2026

It also takes stock of:

💥 EU gas storage levels and ongoing regulatory discussions

💥 Austria’s gas pivot since Ukraine transits ended

💥 What to look out for in the next TTF Commitment of Traders report

If you’re looking for a complete and nuanced picture of European gas in the context of the global LNG market at this critical juncture in energy geopolitics, this datavis-heavy post is for you. Subscribe now for full access.

💥 Article stats: 2,000 words, 9-min reading time, 11 charts and graphs

Member discussion: Sell the rumour…

Read what members are saying. Subscribe to join the conversation.