One for the road?

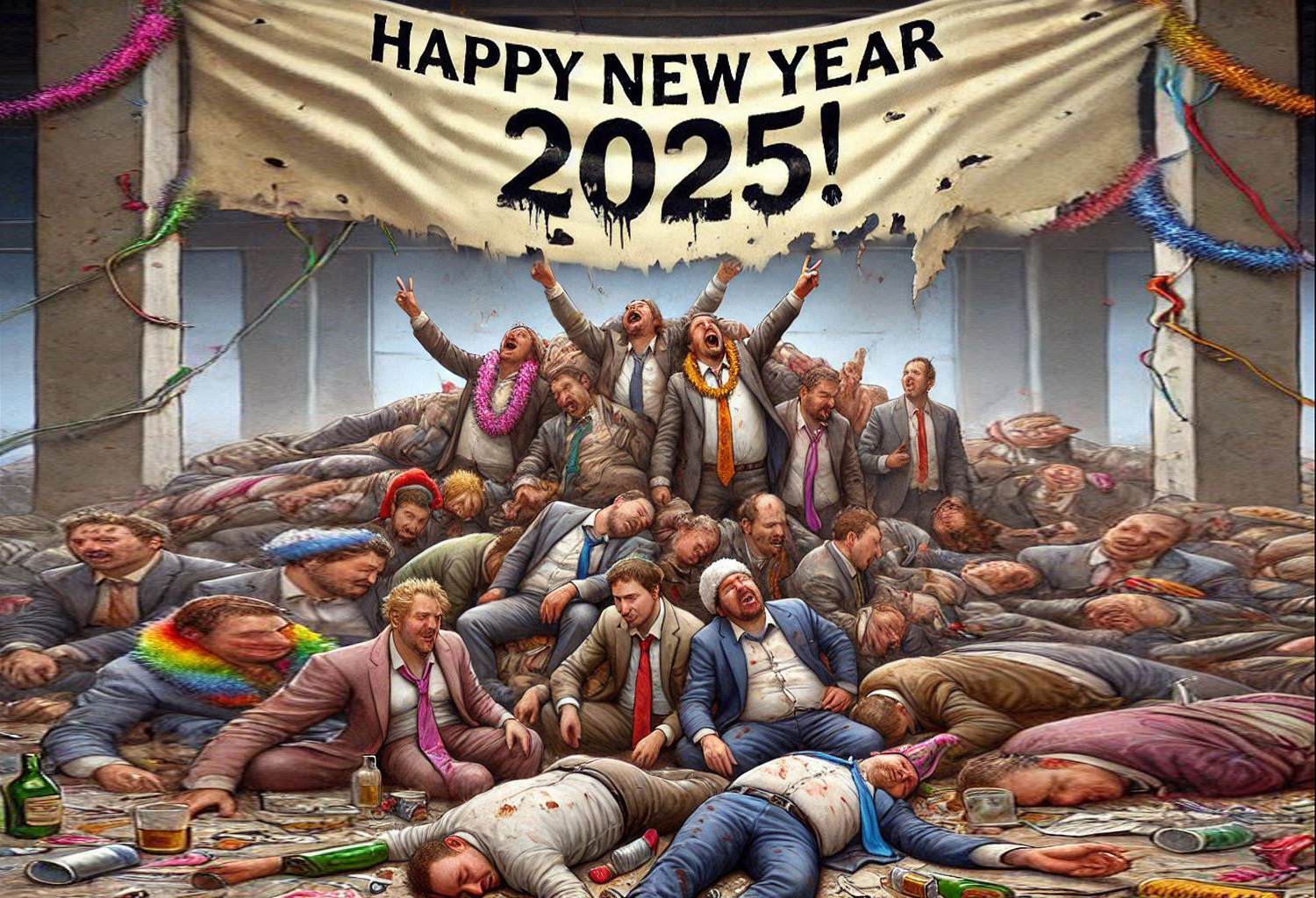

The 2024 bullish party in EU gas markets is not quite over, but an epic New Year hangover awaits | EU LNG Chart Deck: 31 December 2024

- As the clock ticks towards midnight, I thought I would pen a very brief update to put the geopolitical powerplay surrounding the fate of Ukrainian gas transits into perspective. I’ll be back next week with more detailed analysis of recent events for paid subscribers. Until then, wishing all readers a prosperous and energetic New Year. Thanks for reading throughout a tumultuous 2024; I suspect there will be plenty to write about in 2025. — Seb

The fate of Russian gas transits through Ukraine captivated bullish European gas market sentiment in 2024. The interconnector agreement between the two warring countries expires at midnight tonight. Is the party over for EU gas bulls?

Despite intense last-minute geopolitical horse-trading, Russian gas will in all likelihood stop flowing through Ukrainian pipelines on New Year’s Day.

The impending cessation will not come as a surprise, but the market is (yet again) pricing this as if it were as shocking as a Kamala Harris election victory.

Moreover, the transits halt will probably be only temporary. The fate of Russian gas in Europe will be a bargaining chip in peace negotiations under the Trump presidency.

Quite how the new isolationist US administration intends to broker a Ukraine peace settlement is anyone’s guess. Trump has lots of LNG to sell Europeans who are eager to avert a Transatlantic trade war. He is also intent on ending the conflict, one way or the other.

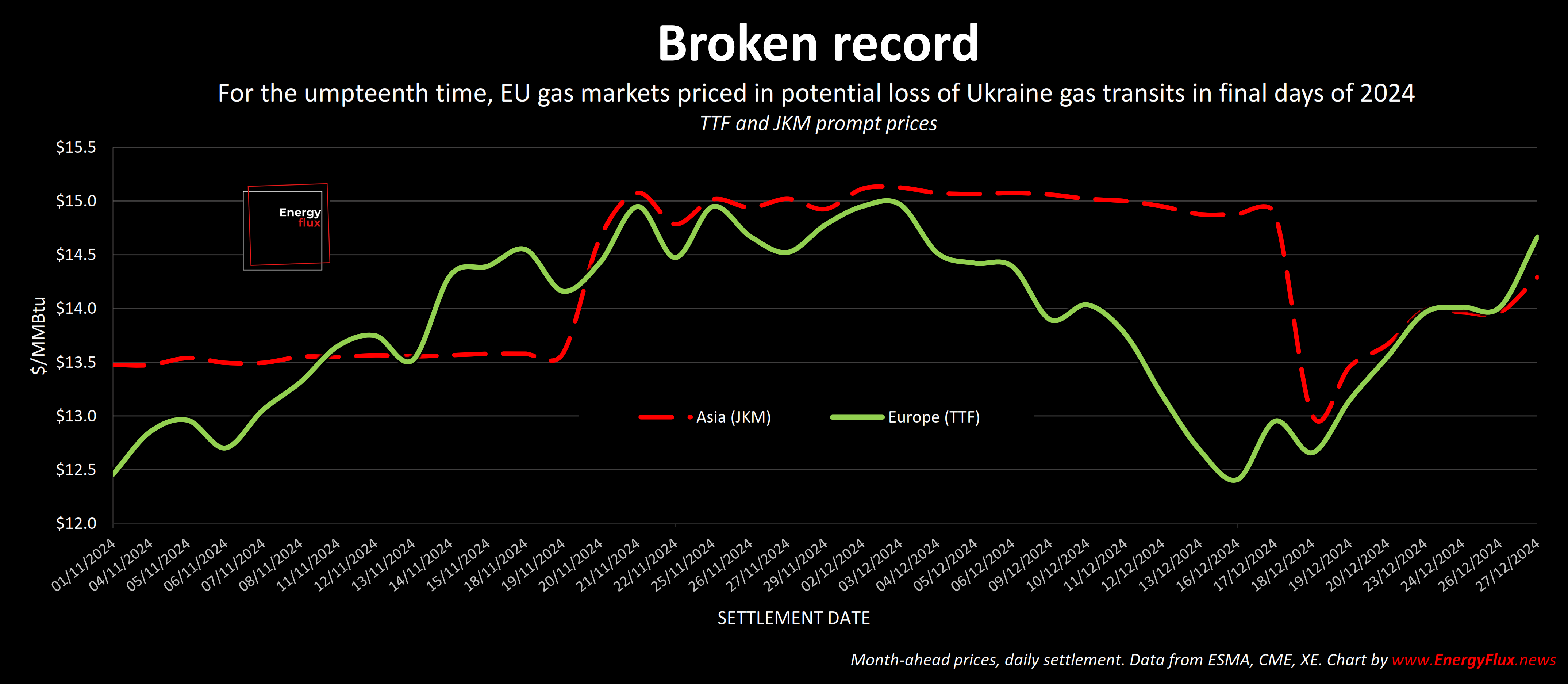

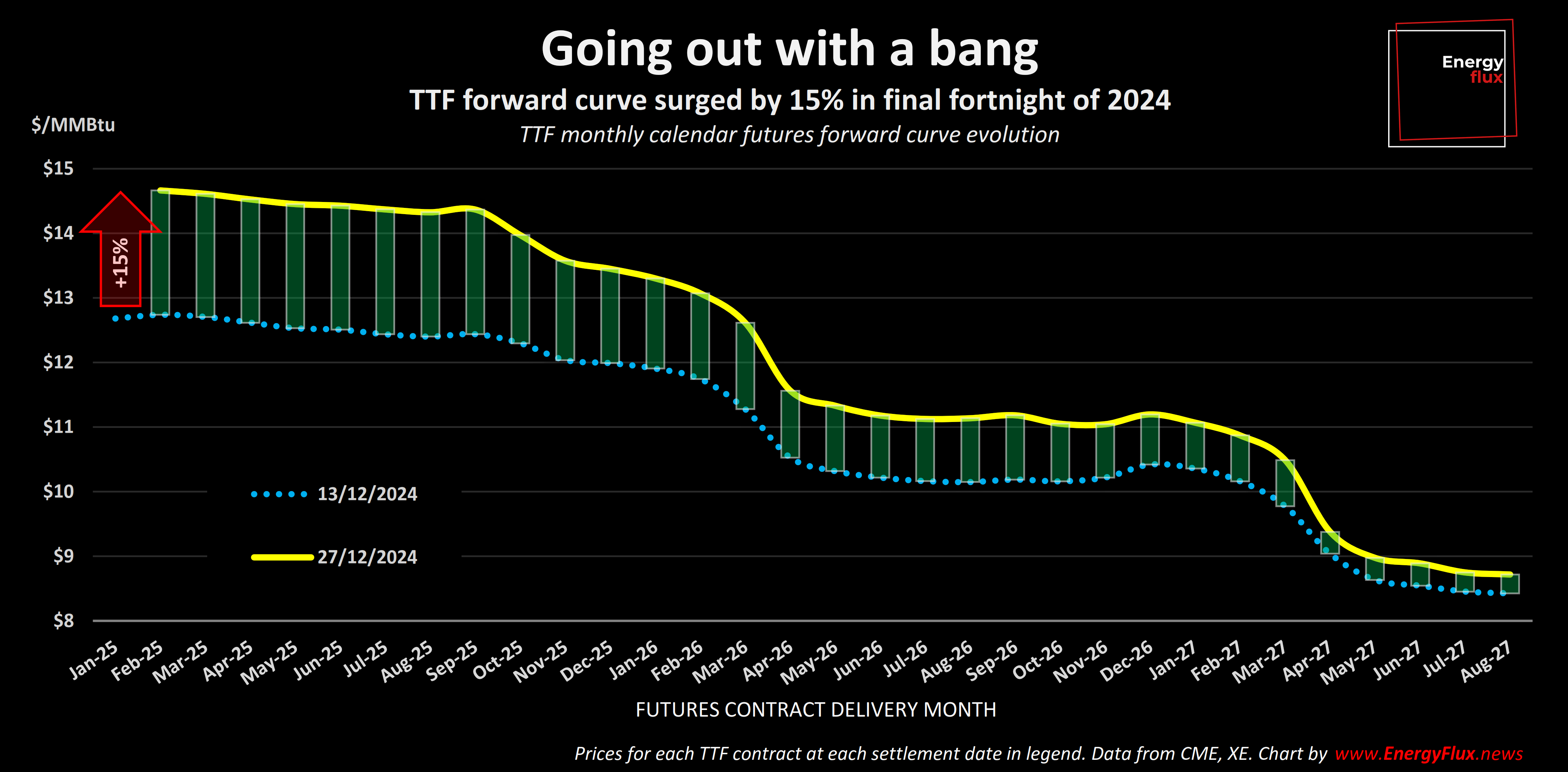

In the absence of clarity, speculation abounds. The imminent loss of Russian gas in Europe is fuelling a fresh bout of extreme price moves on Dutch TTF, Europe’s benchmark gas trading hub.

The only ‘extreme’ thing about the EU gas market heading into 2025 is the amount of political capital being expended behind closed doors to keep Russian gas flowing through Ukraine.

Slovakia’s prime minister Robert Fico made an outlandish threat to halt electricity exports to Ukraine if Kiev refuses to renew the transit agreement. He also wrote a highly dubious letter to European Commission president Ursula von der Leyen claiming cessation would trigger economic catastrophe.1

The country at greatest risk of crisis is Moldova, which sits between Ukraine and Romania, and relies on Russian gas imported via Ukraine for heating and power generation.

The ex-Soviet state is preparing to nationalise gas company Moldovagaz, which is 50% owned by Gazprom, in anticipation of the cut-off on 1 January. Authorities in Moldova’s pro-Russian separatist Transdniestria region have already cut gas supplies to several state institutions.

Victor Parlicov, Moldova’s ex-energy minister, said the Kremlin’s “real goal” is to “destabilise Moldova and plunge it into chaos” at the height of the heating season. A humanitarian crisis looms and ordinary people’s lives are on the line.

Putin’s sympathisers within the EU (such as Fico) are expected to seize on the situation to lobby hard for a resumption of Russian gas flows through Ukraine to all eastern European countries (not just Moldova). The strategy is as cruel and cynical as it is transparent.

Leaving aside the political grandstanding and reckless brinkmanship, everything else about the European gas market is surprisingly average considering the situation.

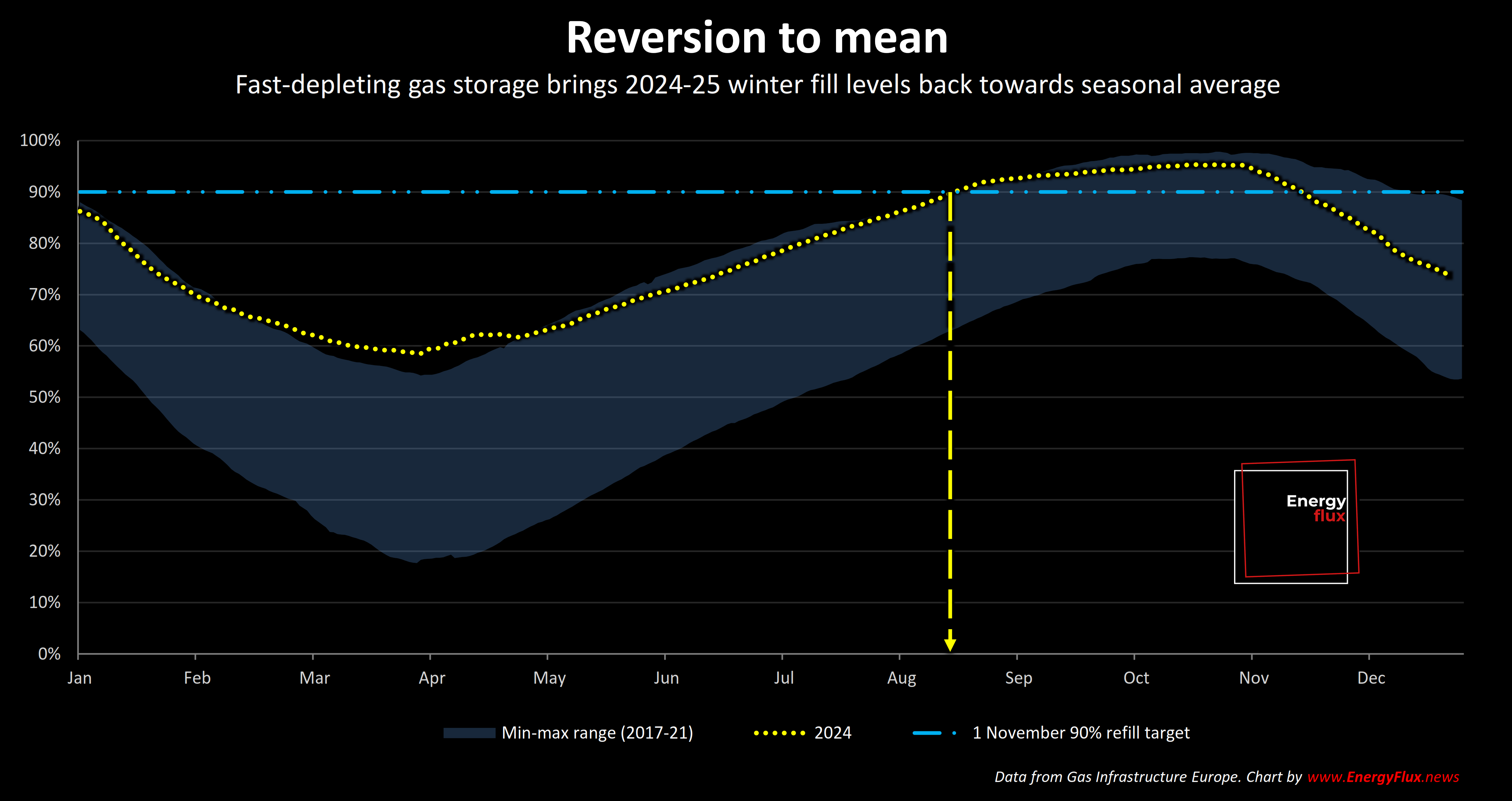

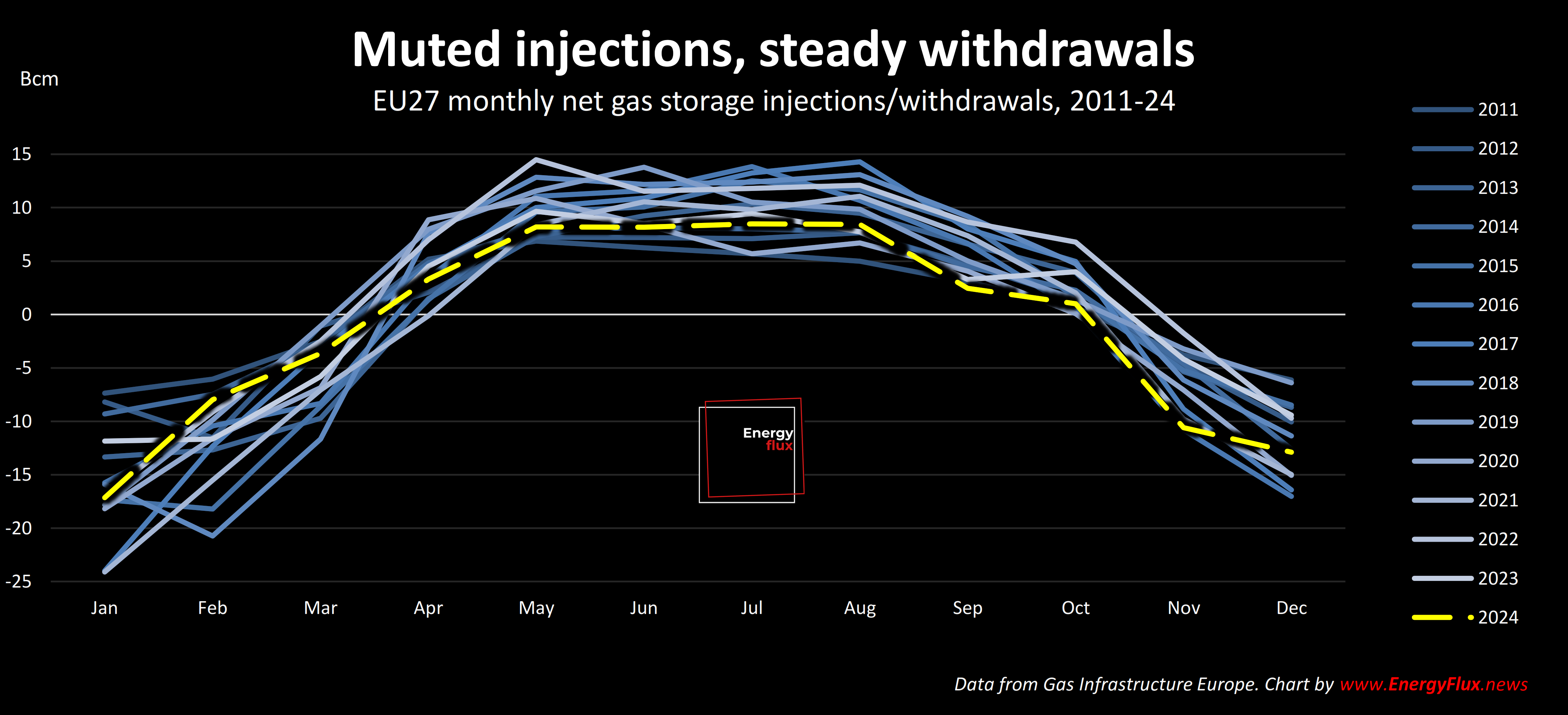

Gas storage levels have reverted to seasonal norms. Rapid depletion of recent weeks is widely held aloft as proof that a crisis is looming and scarcity pricing is inevitable in Q1 2025.

But as explored recently in Energy Flux, this is merely a function of strategic management of storage inventory. Gas storage operators are burning expensive gas at the height of the market to make space for cheaper gas in the New Year.

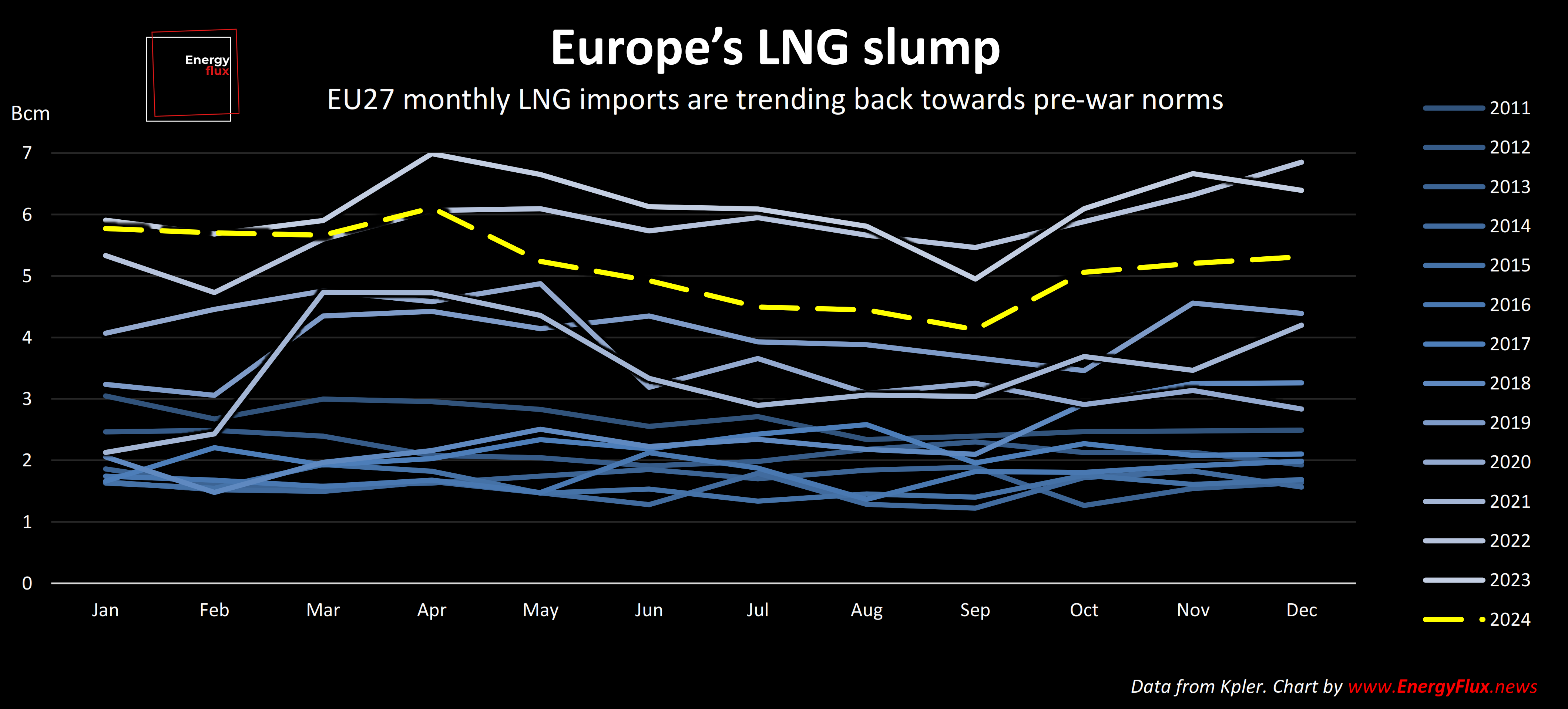

How do we know this? Because Europe’s LNG imports are at a two-year low and are showing no signs of revival.

If there was even the remotest possibility of gas storage levels reaching dangerously low levels, LNG imports would begin racing north to ward off that risk.

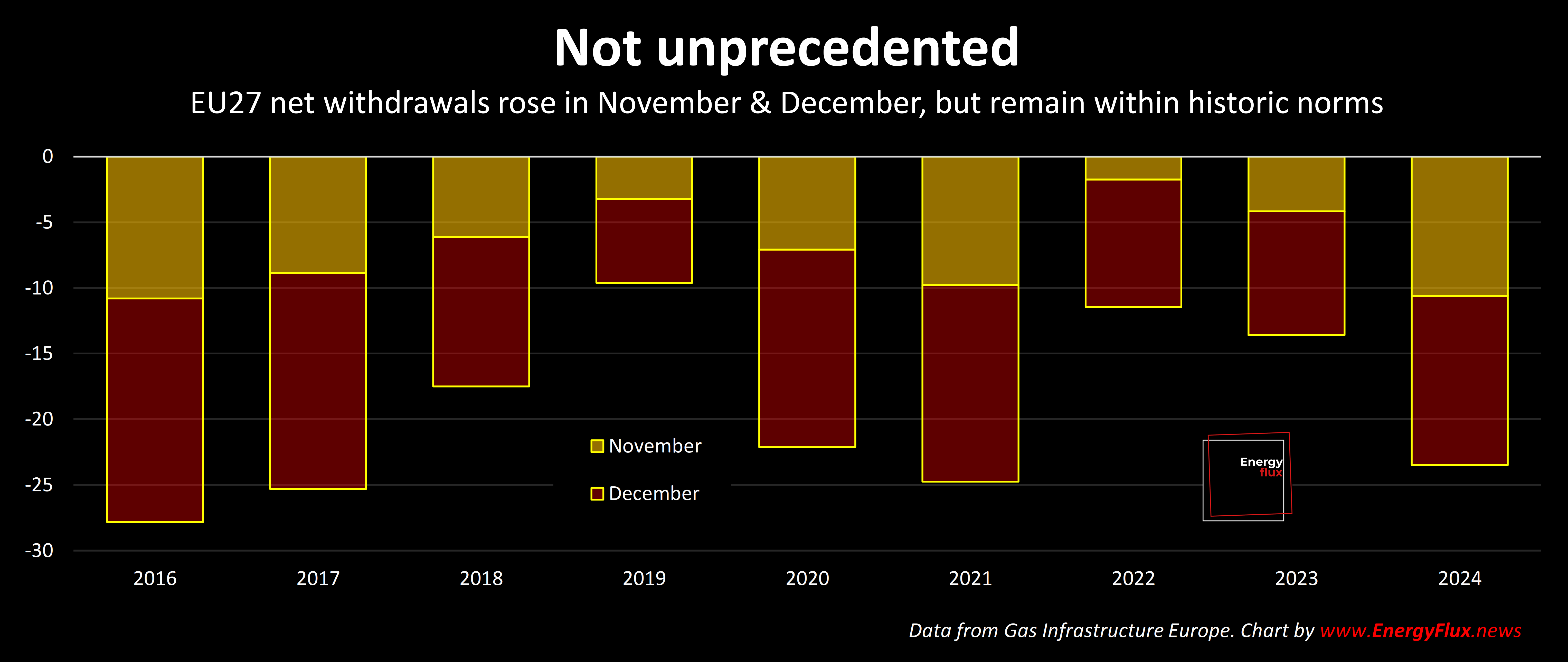

Storage withdrawals are widely reported as accelerating over the last two months.

Certainly, gas destocking was higher in November and December 2024 than previous years. But it was by no means unprecedented.

More stored gas was withdrawn over the same two-month period in 2016 and 2017, when Russian gas flowed freely into Europe, and in 2021, when Europe was contending with Gazprom’s pre-war manipulation of the storage facilities it controlled at that time in Germany.

Heightened withdrawals in November reflected slightly chillier conditions, but depletion eased in December with the onset of milder weather.

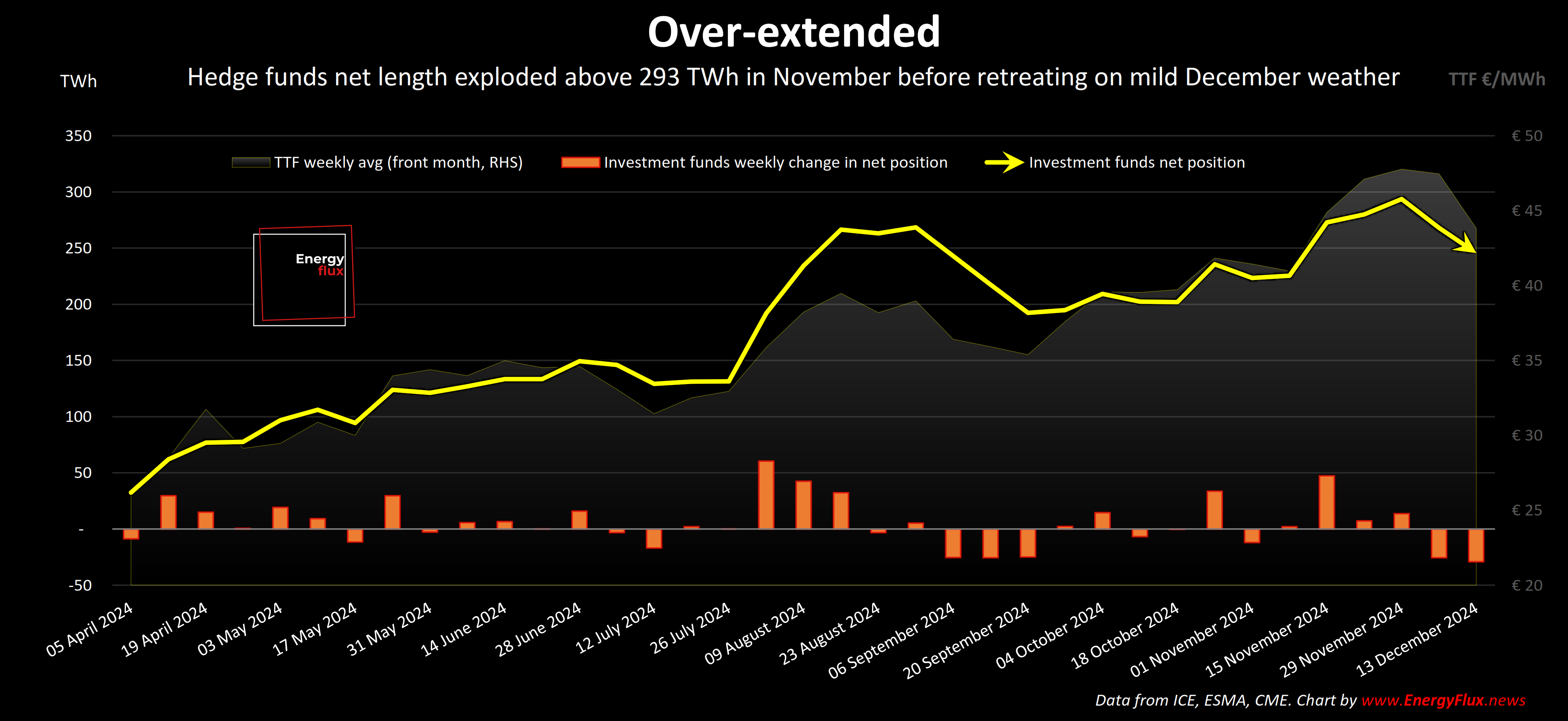

Investment funds took little notice of these facts throughout 2024, and there’s no reason why they should change course in the final days of the year.

The most recent Commitment of Traders report shows a fairly hefty ~55 TWh reduction in hedge fund net length in TTF futures over the last two weeks.

Prices on TTF have since soared by 15%, so I expect the next weekly CoT update will confirm that those positions were largely reversed in the trading sessions either side of Christmas.

If so, this merely sets up the market for a greater correction once hedge funds wake up to the reality that Europe can cope without Russian gas, and without the need for exuberant scarcity pricing to attract the ‘marginal molecule’ of LNG.

That means unwinding as much as 290 TWh of net length in Q1 2025.

Bullish positioning that discounted or ignored fundamental realities proved to be an extremely profitable strategy in 2024. The market swallowed the same ‘supply side disruption’ story over and over again, and consumers repeatedly paid the price.

After months of speculation based on flimsy facts and fake news, that supply-side risk is about to be borne out in reality. Moldova is in a tight spot, but the looming crisis there should be isolated.

Having bought the same old rumour month after month, the market will sooner or later have to sell the cold, hard news. An epic New Year hangover awaits, but the 2024 bullish party has not quite reached its climax.

One for the road?

Seb Kennedy | Energy Flux | 31 December 2024

More from Energy Flux: