New Year, old realities

Bullish habits die hard | EU LNG Chart Deck: 20 January 2025

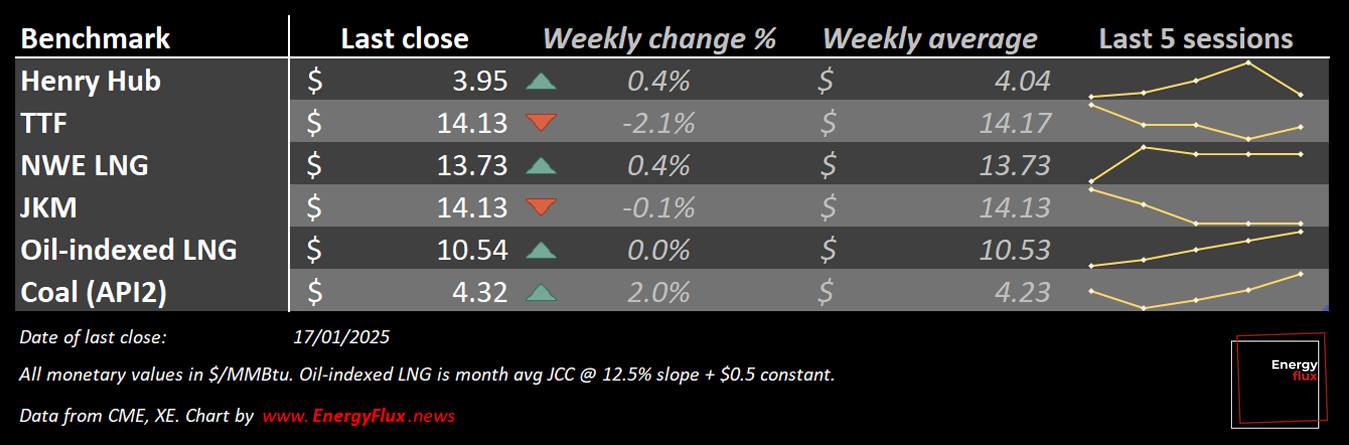

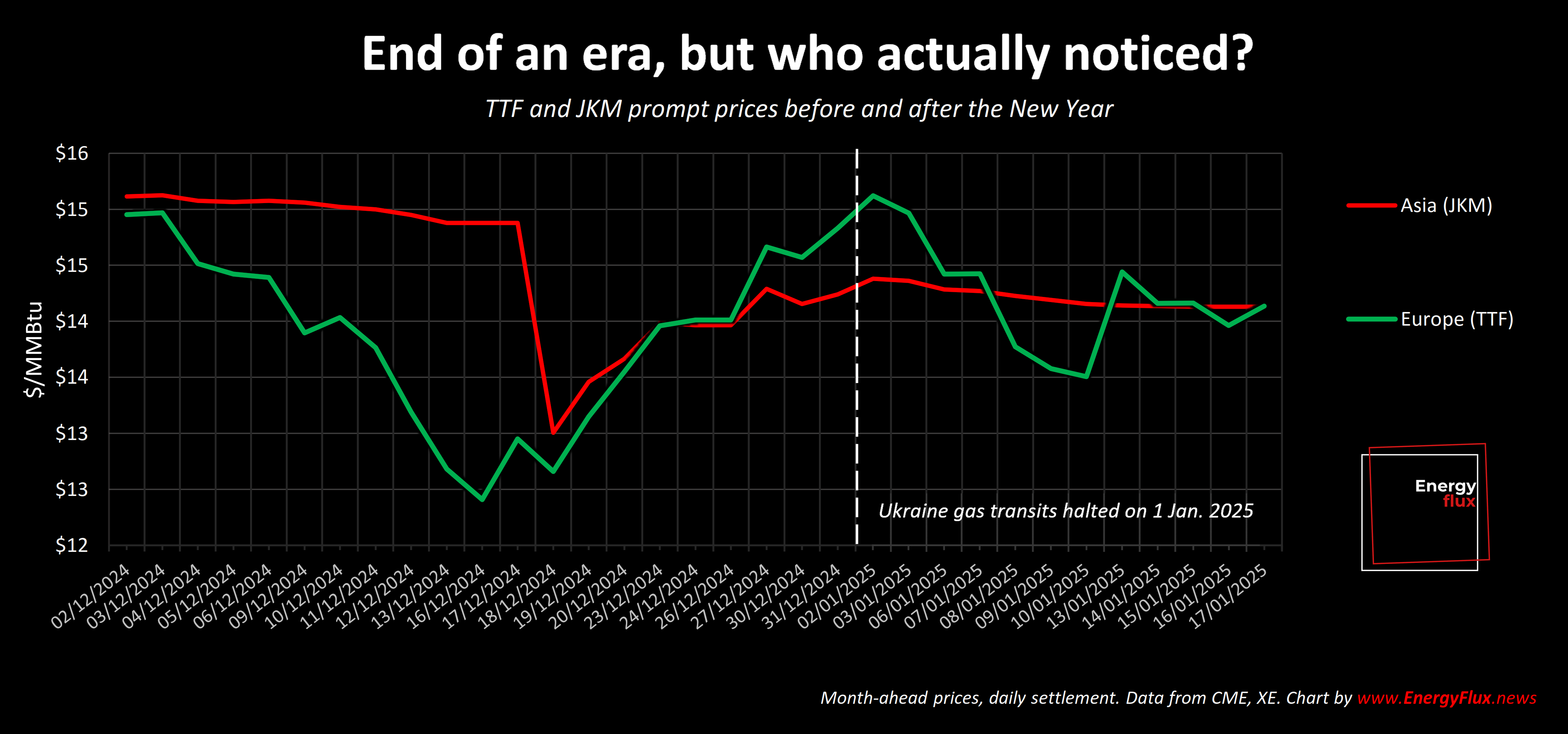

Well, that didn’t last long. The end of Russian gas transits through Ukraine triggered, as predicted, a brief sell-off in EU gas futures in the first trading sessions of 2025. But a fresh salvo of geopolitical headlines quickly reversed the losses, allowing the market to fixate on its next bullish pseudo-narrative.

Dutch TTF, the European gas benchmark, started 2025 in much the same way it ended 2024: with heightened sensitivity to scary-sounding but improbable supply-side risks rather than mundane physical realities.

The narrative that dominated EU gas trade in 2024 was ‘how will Europe cope without Ukraine gas transits?’. When risk became reality, it was soon clear the sky would not fall in (spare a thought for Moldova, mind). So a new narrative was needed.

Now, a parade of credible-looking analysts and pundits are sounding the alarm over EU gas storage levels amidst ‘the coldest winter in years’ (sic).

No reflection on the fact that consumers are on the hook for a doubling in wholesale gas costs in 12 months, predicated largely on a supply risk that proved entirely manageable when it finally happened. Barely time to pause for breath, the fear factory waits for no-one.

The conspicuous narrative pivot was aided and abetted by a flurry of ostensibly bullish news headlines in the first two weeks of the year, which halted the downward momentum.

Front-month TTF settled at a low of €44.99/MWh ($13.58/MMBtu) on 9 January before rebounding into the €46-48/MWh range for most of last week.

There is a lot to unpick in the way the market is balanced. This bumper New Year edition of the EU LNG Chart Deck covers a lot of ground:

- News flow since 1 January & market reaction on Dutch TTF

- Hedge fund positioning before/after Ukraine transits halt

- Negative US-Asia arb drives upsurge in EU LNG inflows

- Fresh LNG freight rate plunge, negative breakevens

- EU gas storage depletion trajectory & abysmal restocking economics

- Geopolitical tinderbox + flat TTF term structure = extreme volatility

- A look ahead to a year of whipsawing price gyrations

In keeping with my New Year’s resolution to be more circumspect, this post concludes with some reflections on the need to reconcile quantitative logic-based analysis with qualitative factors (such as human psychology).

I haven’t changed my outlook entirely, but I definitely feel a need for greater nuance and analytical latitude to accommodate the ominously wide scope of geopolitical possibilities facing us in 2025 — many of which will flow from today’s seismic US presidential inauguration.

Subscribe now for full access and support independent energy market analysis

Article stats: 2,700 words, 12-min reading time, 14 charts & graphs

Member discussion: New Year, old realities

Read what members are saying. Subscribe to join the conversation.