Gas flood sinks canal crisis

Oversupplied LNG market shrugs off canal outages | EU LNG Chart Deck: 19 Feb-1 Mar 2024

If ever there was a good time for the LNG industry to confront a shipping crisis, this is it.

Drought and conflict might be triggering simultaneous outages on the Panama and Suez canals, but prices on key gas and LNG benchmarks remain muted. The market response to loss of passage through two vital waterways has been a shrug of indifference. Why? Low shipping costs.

If these chokepoints had become constrained during the extreme market events of 2022, the response would have been quite different. Charter rates peaked at $375,000 per day in October 2022, which would have blown a big hole in the economics of an 82-day round trip from the US Gulf to Tokyo or Beijing.

Today charter rates are languishing at one-tenth of that, so longer voyage times are not impossibly expensive.

Weak fundamentals are a bearish factor weighing on shipping costs.

European gas stocks are brimming after a mild winter, renewables are squeezing fossils out of the power mix, and demand recovery is at best insipid in both the industrial and heating segments.

It’s a similar story in Asia. The difference is that spot LNG has deepened its discount to oil-indexed contracts, which is driving some bargain-hunting — but nothing likely to move the needle on global balances.

This week’s EU LNG Chart Deck reviews recent European and Asian price movements, evolving forward curves and time spreads over the spring, summer and winter months.

It also considers the implications of the global LNG fleet failing to optimising in response to ongoing canal transit restrictions.

This post is broken into the following sections:

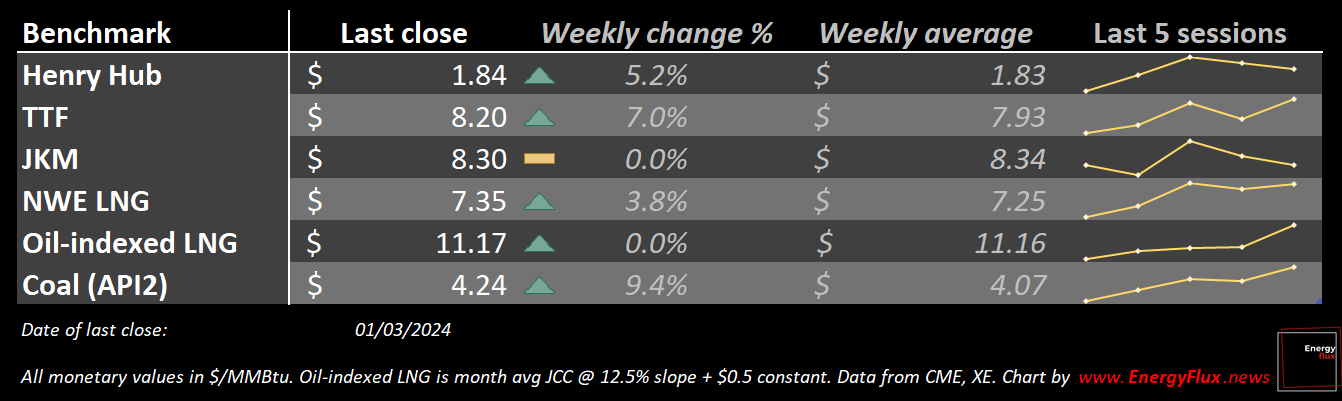

- Global gas benchmarks stop the rot

- Flat time spreads dull injection incentive

- ‘TTF is going sub-$8’: analysts

- Inter-basin spreads collapse

- Price drop spurs bargain hunters

- Spot discount to oil indexed LNG widens

- Vessel market tightening sooner…

- …but looser market beckons in 2025

- No need to optimise trade flows (yet)

- Curious vessel movements — the exception that proves the rule

- Conclusion: crisis averted, opportunity squandered

Be sure to enable images or, better still, read this post on the website.

Article stats: 2,400 words, 11-min reading time, 12 original charts, graphs and maps

Member discussion: Gas flood sinks canal crisis

Read what members are saying. Subscribe to join the conversation.