Japan follows UK down the deregulation rabbit-hole

Import dependency means a ‘laissez faire’ energy policy carries much greater risks

I once interviewed a Japanese economist in Tokyo about Japan’s energy market deregulation agenda. I asked him which country or market Japanese government officials looked to as an example of successful electricity and gas market liberalisation. Without hesitating, he said: “The UK.”

Britain’s experiment with privatisation in the 1980s, followed by successive bouts of energy market reform throughout the 2000s and 2010s, became a global reference. Unbundling vertically integrated monopolies and exposing incumbents to upstream/generation and retail competition was seen as a winning formula. Cutting the red tape unleashed market efficiencies, which lowered prices for end consumers — until energy markets crunched, that is.

I wonder what the Japanese economist would make of the implosion of the UK energy retail segment. Regulator Ofgem last week approved an eye-watering 54% increase in the retail price cap, which will push millions of households towards energy poverty. Further rises are expected in October, and with increasing frequency thereafter to keep up with an erratic market.

The regulator was caught between competing priorities: protect customers, or allow loss-making suppliers to recover ballooning wholesale costs from consumers. After bailing out major independent utility Bulb, political appetite for further intervention is low. Ofgem chose to hike the cap to prevent further supplier failures. Cue much hot air from politicians (although sadly not enough to keep the homes of energy-poor Britons warm this winter).

The 2021-22 winter won’t be a one-off. As I’ve written about elsewhere, the combination of liberalisation and decarbonisation is a recipe for volatility. The switch to short-term market-based gas pricing slashed billions of dollars off European import costs over the past decade, only for those savings to be almost entirely wiped out in a matter of months when global LNG prices spiked last autumn. Wholesale gas and power prices remain inflated and the cost to consumers will keep stacking up until the market cools off and losses are settled.

I don't know if folks understand the INSANITY of European gas prices. Maybe the quote in € per MWh is not intuitive. Here is the data in dollars per barrel. Brent hit $146/bbl in 2008 and EVERYONE freaked out. TTF has traded 94 DAYS (!) above $146/bbl. THIS ISN’T NORMAL!

— Nikos Tsafos (@ntsafos) 3:01 AM ∙ Feb 9, 2022

Red tape meltdown

Regulators and politicians will need to get used to making difficult trade-offs as the energy transition progresses, and not just in liberalised UK or European markets. Import-dependent Japan is facing the same challenges. All of Japan’s 10 regional utilities slashed their earnings estimates for this business year on soaring oil, gas and coal prices.

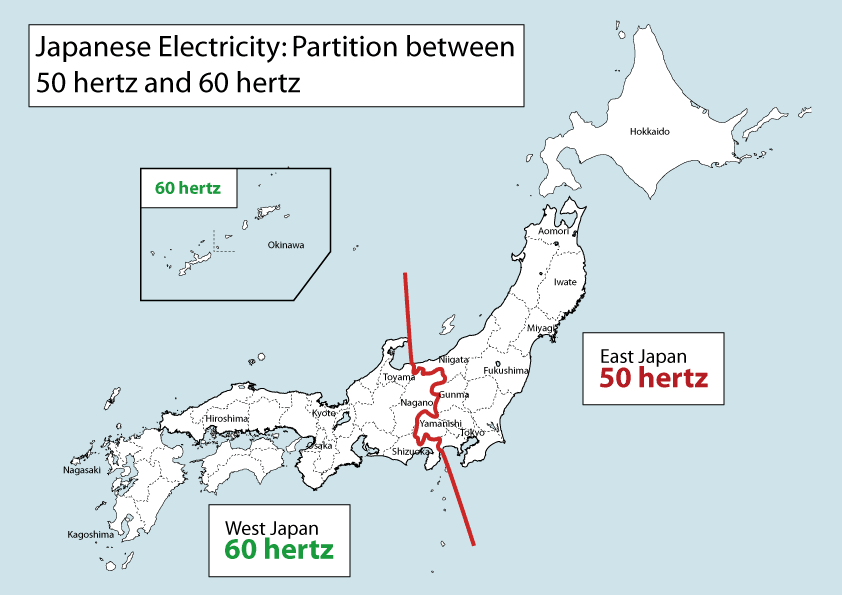

Japan arrived late to the deregulation party, thanks partly to the physical segmentation of its power grid into two distinct networks running at different frequencies, and the lack of interconnection between regional natural gas distribution networks. These barriers perpetuated the natural monopolies presided over by state-run or municipal utilities.

Member discussion: Japan follows UK down the deregulation rabbit-hole

Read what members are saying. Subscribe to join the conversation.