Gas, carbon, and the geopolitical web

PODCAST + DEEP DIVE: War, insecurity and runaway TTF speculation are complicating Europe’s energy transition

January got off to a cracking start with an invitation to appear on the Carbon Trading Chronicles podcast, hosted by the folks at Vertis Environmental Finance. The episode is now live and available on Apple, Spotify and other platforms.

We covered a lot of ground in 40 minutes:

- broad trends in European natural gas markets

- the fundamental vs. geopolitical panorama for gas at the start of 2025

- short- and medium-term gas & carbon price outlooks

- the future of Russian gas in Europe

- strategic management of EU natural gas inventories

- LNG market ‘tightness’ (or lack thereof at current pricing levels)

- the correlation between EU gas and carbon prices

In preparation I crunched some numbers to understand what drives the EU carbon price, and ended up falling down another gas-adjacent rabbit hole.

I shared some initial findings on the podcast. Since the recording I’ve had more time to refine the analysis and think through the implications. This post lays it all out.

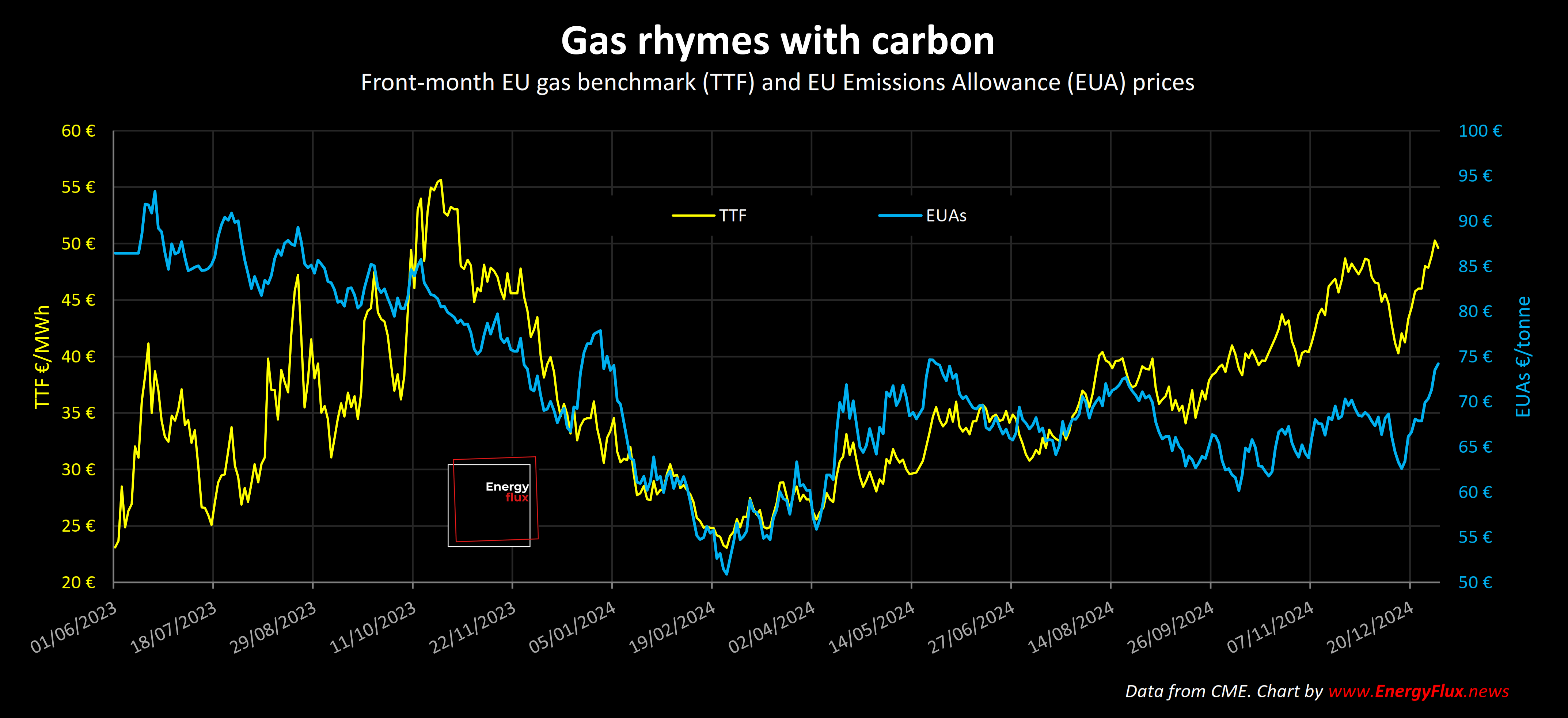

Gas rhymes with carbon

The Emissions Trading System (ETS) is the core instrument for incentivising decarbonisation in Europe. The ETS is a cap-and-trade system, where a cap is set on the total amount of greenhouse gas emissions allowed from covered sectors.

For every tonne of carbon dioxide emitted, a producer must buy an allowance (EUA). The cap is gradually reduced to achieve EU climate targets, meaning that the supply of EUAs decreases over time.

A stable carbon market is vital to underpinning long payback investments in clean technologies and fuels. But it appears that financial speculation in natural gas prices is fuelling unpredictable CO2 price movements.

I spent a lot of time last year analysing how investment funds are bidding up gas futures on Dutch TTF, the EU’s benchmark gas trading hub. It turns out, these speculative capital flows are also indirectly inflating the price of EU Emission Allowances (EUAs).

When big emitters buy and sell EUAs for compliance or commercial purposes, the impact on the carbon price is surprisingly muted. By contrast, the price correlation between gas and carbon is very strong.

The gas price is highly correlated with speculative fund positioning in Dutch TTF futures, so there is a significant link between hedge fund positions on TTF and the price of EUAs.

And since hedge funds are extremely attuned to news events, the upshot is that geopolitics (rather than CO2 emissions) are driving Europe’s carbon market.

I barely scratched the surface of the gas-carbon-geopolitics nexus on the podcast. This subscriber-only post dives deep into the complexities and nuances at play, how the speculative price correlation could evolve, and the implications for Europe’s energy transition. Subscribe now for full access.

- ARTICLE STATS: 2,000 words, 10-min reading time, 13 charts and graphs

Member discussion: Gas, carbon, and the geopolitical web

Read what members are saying. Subscribe to join the conversation.