Everything must go!

DEEP DIVE: Europe is draining stored gas as fast as possible, while dialling down LNG imports. Why?

Europe is burning through its winter gas stocks at an unnerving rate. Rapid depletion of underground storage facilities has set alarm bells ringing across EU capitals. The question on everyone’s lips: is it 2022 all over again?

In a word: no. Only a deep and prolonged ‘Beast from the East’ winter blast could change that assessment. Here’s why.

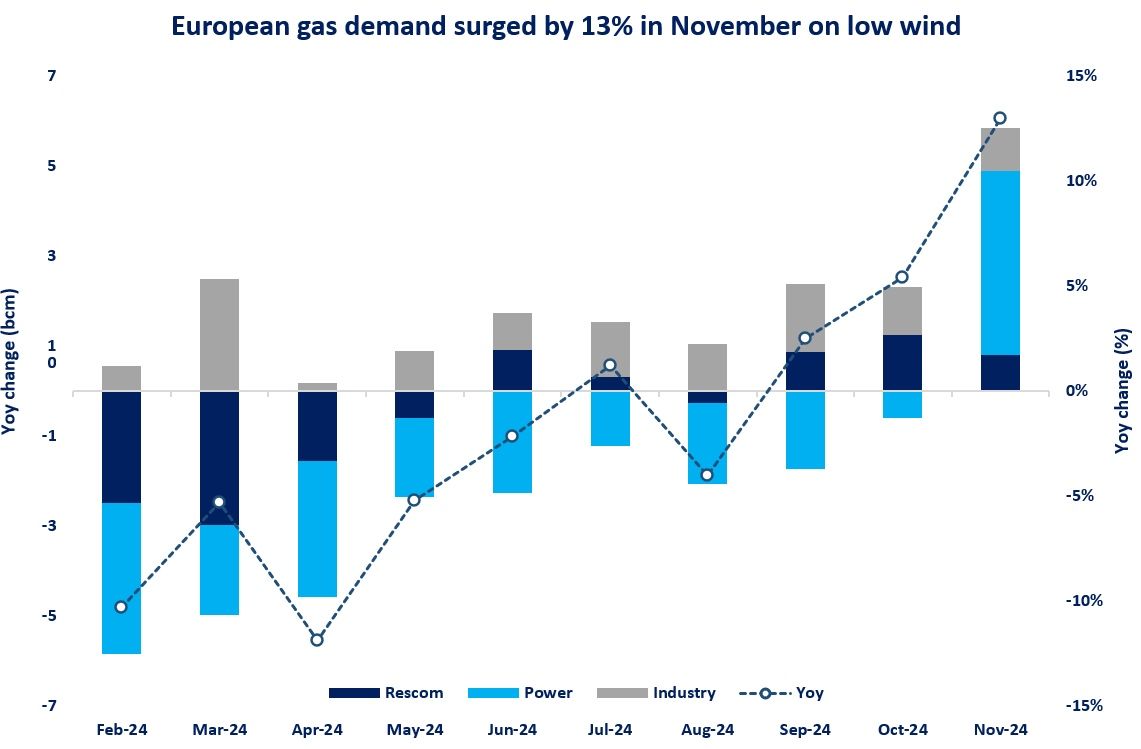

Europe witnessed a notable uptick in gas demand across all economic segments in November.

For the first time this year, gas consumption rose in the residential, power generation and industrial sectors simultaneously.

Low wind and a cold snap triggered a surprisingly large storage drawdown to replace subdued renewable power generation and to keep homes and offices warm.

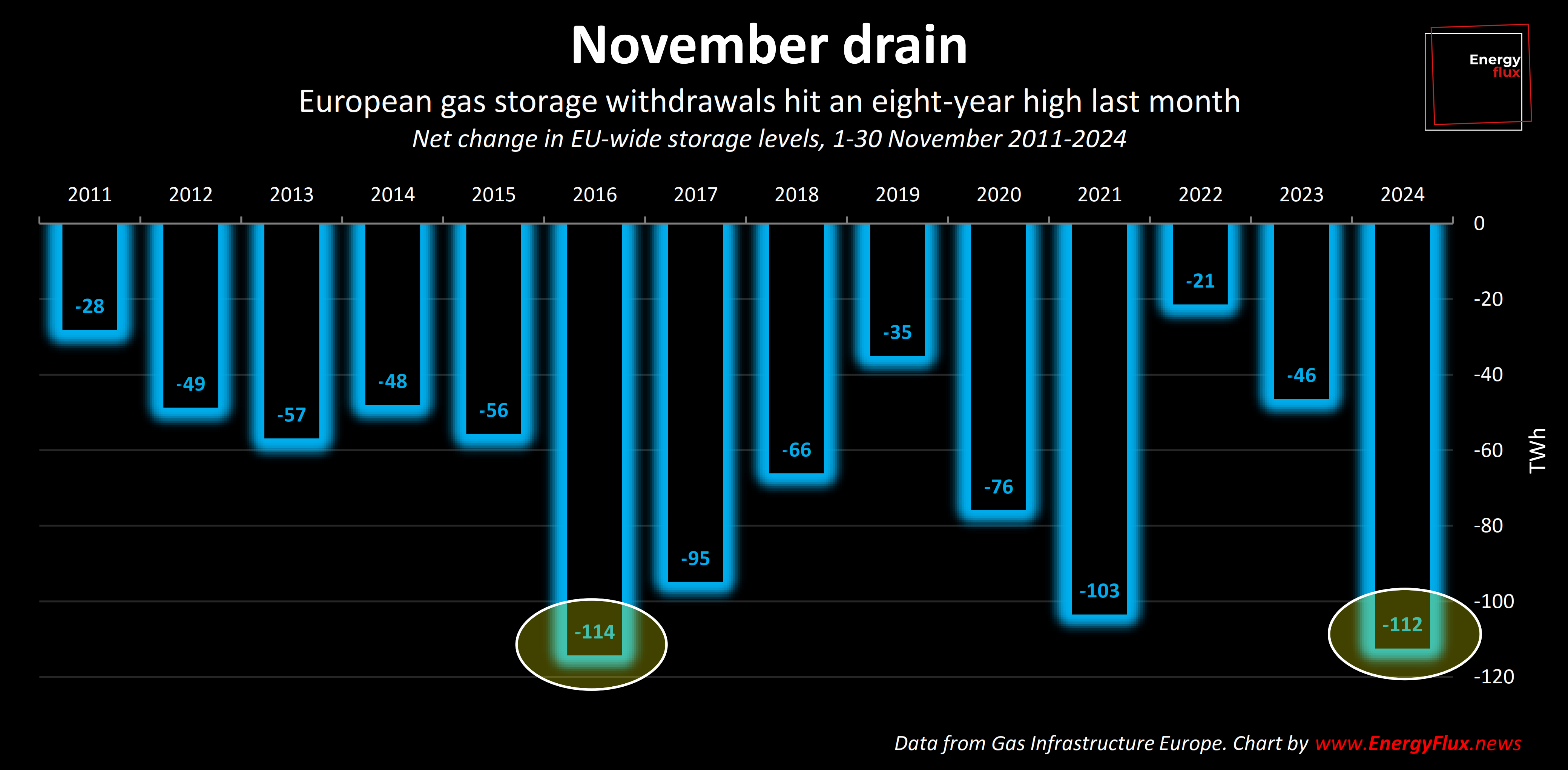

Net withdrawals in November amounted to 112 TWh (roughly 6 Bcm), the highest drawdown for that month since 2018, and 66 TWh greater than 2023.

Coincidentally, 6 Bcm closely matches the increase in gas demand over the same period.

In other words, the entirety of November’s demand uptick was met by pulling gas from storage.

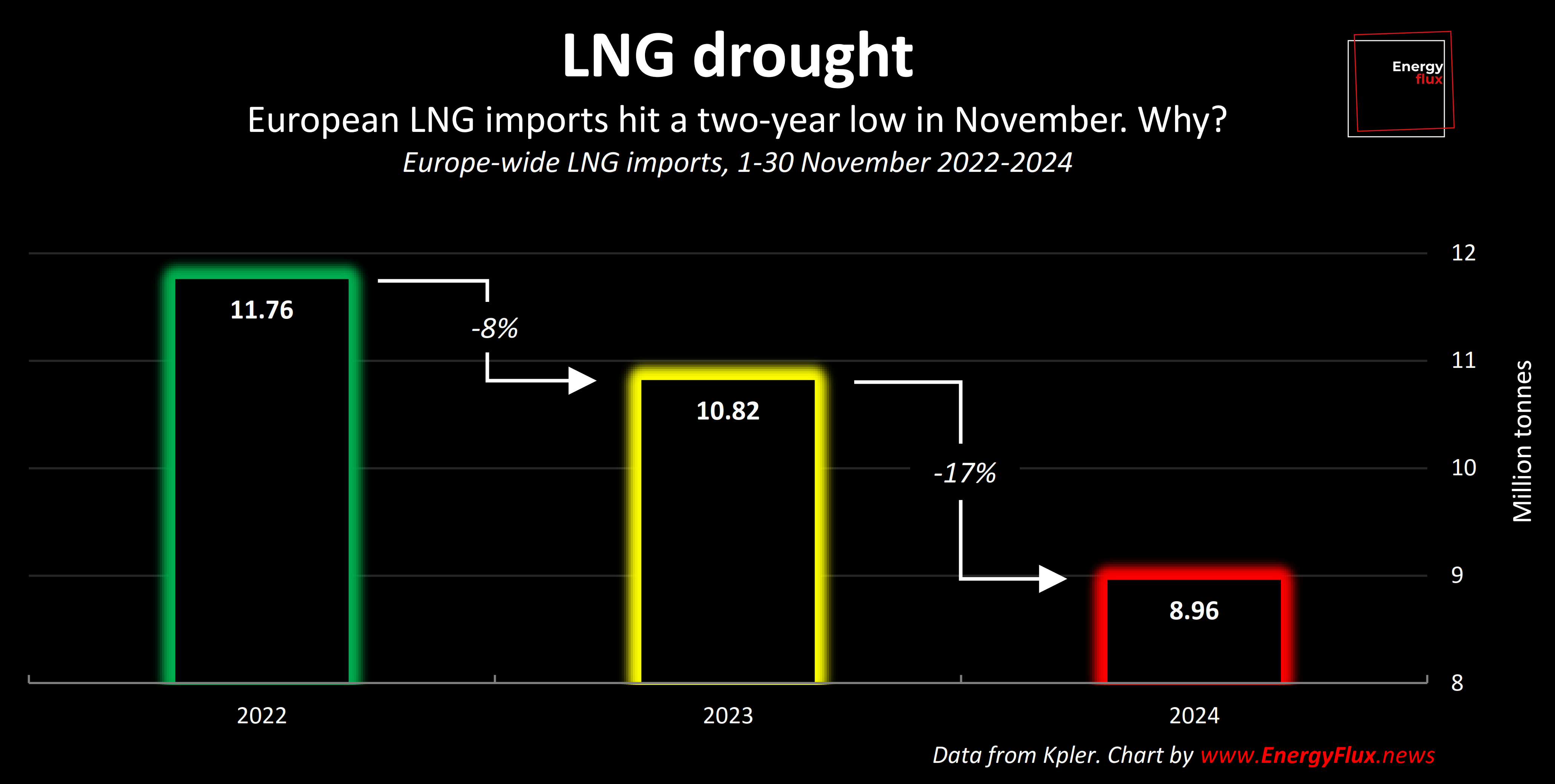

At the same time, European imports of liquefied natural gas (LNG) fell to a two-year low.

Europe’s LNG imports were 1.86 million tonnes lower in November 2024 than the previous year. That’s equivalent to roughly 28 TWh (~2.5 Bcm) of ‘missing’ natural gas.

The net effect was plummeting storage levels and a torrent of fear-mongering in the mainstream press about a return to the dark days of 2022 when the post-invasion risk premium sent prices parabolic.

Few paused to ask the obvious question: Why, in the midst of a supposedly ‘tight’ gas market and early winter cold snap, would Europe not be outbidding Asia to lure in every spare LNG cargo from the spot market?

Current gas market dynamics are routinely ascribed to ‘market tightness’. But the ‘scarcity narrative’ does not adequately explain what’s going on.

For a deeper analysis, you need to consider the hedging strategy of ‘Commercial Undertakings’ — physical players such as gas producers and suppliers.

This Deep Dive uses original data analysis of Commercial Undertakings’ holdings on the Dutch Title Transfer Facility (TTF).

The findings shed new light on why Europe’s gas storage levels are being allowed to deplete so quickly.

These data-rich insights are not available anywhere else. This is market-critical information at a critical moment in energy markets. Subscribe now for full access.

ARTICLE STATS: 2,000 words, 10-min reading time, 12 charts and graphs, 1 data animation

Member discussion: Everything must go!

Read what members are saying. Subscribe to join the conversation.