Asia’s LNG bottleneck (part 1)

DEEP DIVE: Will infrastructure constraints burst the Asian LNG demand growth narrative?

Asia could be facing a liquefied natural gas bottleneck. A projected surge in demand for the fuel threatens to overwhelm import capacity in some emerging markets before 2030. Localised pinch-points would limit the region’s ability to absorb the imminent wave of new global LNG supply — with implications for the global gas balance in the second half of the decade.

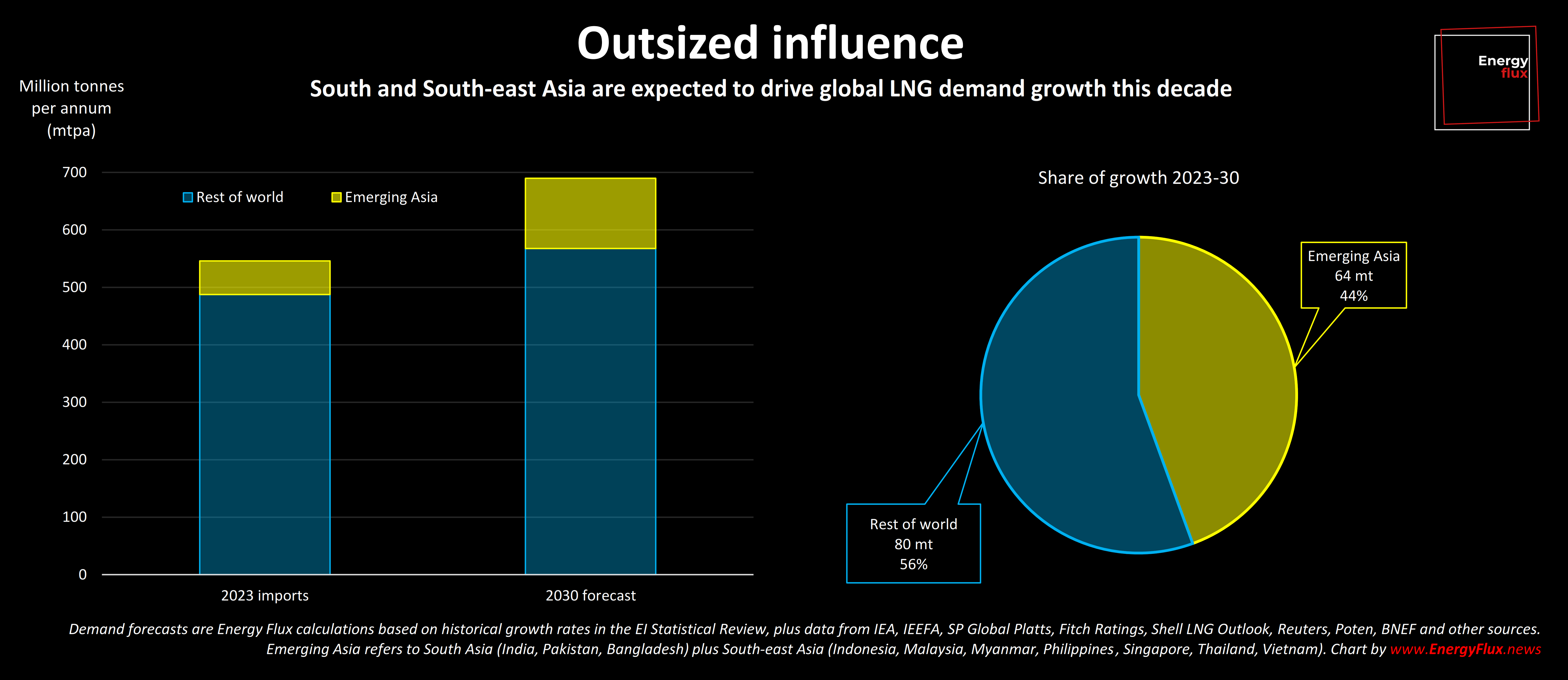

South and South-east Asia are expected to account for almost half of global LNG demand growth, according to Energy Flux estimates. Current regasification capacity can’t accommodate all of the projected increase.

A drive to expand import capacity is underway in India, Pakistan, Bangladesh, Thailand, Vietnam, and the Philippines. But a shortfall is likely in some key growth markets due to the very high failure rate of LNG regasification infrastructure projects across the region.

Regasification, for the uninitiated, is the process whereby super-chilled liquefied gas is warmed back into a gaseous form, for distribution to end consumers or for combustion in a gas-fired power plant. If a country’s demand for LNG exceeds the available ‘regas’ capacity at import terminals, then growth will stall.

There is a distinct possibility that some fast-growing emerging Asian economies could find themselves in this situation before 2030. Analysis by Energy Flux, with assistance from Global Energy Monitor, reveals the extent of the problem (special thanks to Rob Rozansky of GEM for help with data mining).

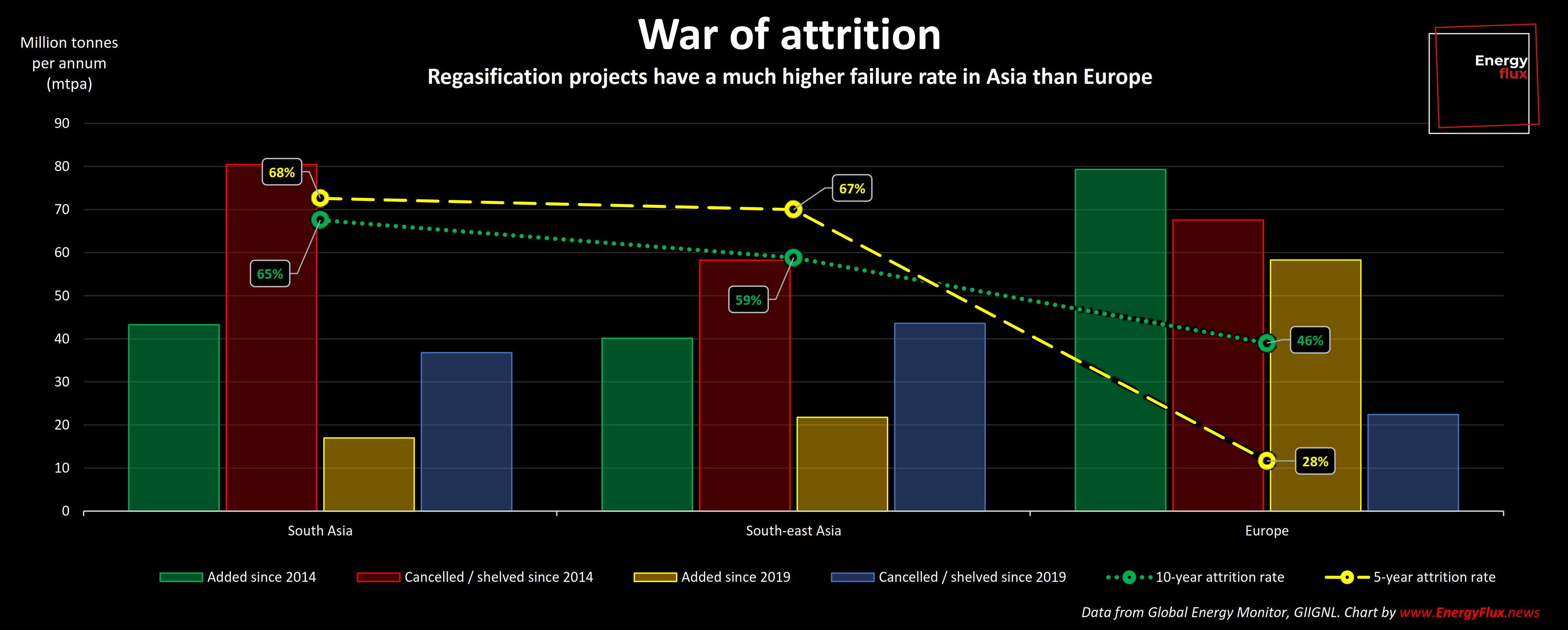

Over the last ten years, 65% of proposed new LNG import terminal capacity in South Asia has been shelved or cancelled. Over the last five years, that figure rises to 68%. In South-east Asia, the failure rate is 59% over ten years, and 67% over the last five years, according to GEM’s open access Global Gas Infrastructure Tracker.

Asian LNG terminal failure rates compare very poorly with Europe. The old continent’s attrition rate has fallen from 46% over the last decade to just 28% over five years, a result of the EU’s concerted dash to build new facilities when Russia slashed pipeline gas exports in 2021-22.

The failure rate of Asian LNG terminal projects is increasing, while Europe’s is falling — precisely the opposite of what ought to happen. After going on a terminal-building spree, Europe doesn’t need more capacity.

But emerging Asia does if it is to become the much-hyped growth engine of global LNG demand. Oil majors such as Shell and TotalEnergies are banking on these economies hoovering up all the extra cargoes that are going to hit the market in the coming years (and thereby prevent a big LNG glut in 2027-28).

This raises the question: how much new LNG regasification capacity is likely to be built across emerging Asia this decade? And how does this ramp-up compare with forecasts for surging LNG demand in the world’s fastest-growing economies?

The short answer is that infrastructure is likely to be a limiting factor on Asia’s LNG demand growth story in a handful of key markets.

A more nuanced answer is that the severity of the bottleneck in each market depends entirely on several overlapping factors. Only if demand falls well short of expectations across the region will one be averted entirely.

This special two-part Deep-Dive — which has been months in the making — takes a look at the data to flesh out those nuances.

It reveals where the infrastructure bottlenecks are most likely to emerge, and how acute they could be under various demand and infrastructure buildout scenarios.

Part one (this post) examines:

- The attrition rate of LNG import projects on a regional and country-level basis across South and South-east Asia

- The likely 2030 buildout of LNG import capacity in each country, and how this compares to the LNG demand outlook

- The likely surplus/excess of regasification capacity in each country by 2030, and implied infrastructure utilisation, according to differing LNG demand scenarios

Part two, available here, delves deeper to explore:

- The likelihood of LNG bottlenecks emerging across a matrix of attrition rate and LNG demand scenarios

- The average time to deliver different types of new LNG import capacity in the region, and factors impeding delivery in each country

- The implications of import capacity constraints on the global gas balance in the latter half of this decade

- What all this this means for European gas buyers and consumers, and the role of gas in Europe’s energy transition

This first instalment is quite long and looks much better on the website. Be sure to open the web version in a browser for an optimal reading experience.

Subscribe now for full access, and to ensure you don’t miss part two when it drops.

ARTICLE STATS: 2,300 words, 11-min reading time, 6 original charts and graphs